CFD and FX broker Plus500 Ltd (LON:PLUS) today posted its unaudited preliminary results for the year ended 31 December 2021. Whereas the financial metrics were far from impressive, the broker has managed to report some milestones in terms of operations, including a new license in Estonia.

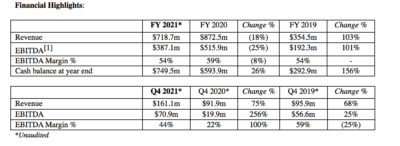

- Plus500 generated total revenue in FY 2021 of $718.7 million, down from $872.5 million in the preceding year. The result includes revenue of $161.1 million in Q4 2021, up from $91.9 million registered in Q4 2020.

- Customer Income was $702.8 million, down from $997.5 million in the preceding year.

- EBITDA for FY 2021 was $387.1 million, down from $515.9 million in FY 2020.

- Net profit in FY 2021 was $310.6 million, down from $500.1 million in FY 2020.

The Group’s portfolio of operating licenses was further strengthened with the addition of a new license in Estonia, granted by the Estonian Financial Supervision Authority on 7 February 2022. This new license will further support the Group’s business across European markets in its core product offering and is supported by the establishment of a new local operating subsidiary.

In 2021, Plus500 executed the US acquisitions of Cunningham Commodities LLC, a regulated Futures Commission Merchant, and Cunningham Trading Systems LLC., a technology trading platform provider, which established the Group’s position in the futures and options on futures markets in the US. Through these transactions, Plus500 immediately expanded its geographic footprint and product offering in the significantly growing, but under-penetrated, US retail trading market in futures and options on futures.

Plus500 says the integration of these acquisitions is underway, with a number of R&D specialists recruited during FY 2021 with a specific focus on leveraging Plus500’s technology to optimise the acquired businesses.

During the year, the Group successfully launched a share dealing platform, ‘Plus500 Invest’, in over 15 countries across Europe. The platform, which was developed in-house by Plus500, includes a wide range of around 1,500 financial instruments comprising of the world’s most popular equities, with a high quality, user-friendly and intuitive customer experience.

‘Plus500 Invest’ was also recently launched as a native application on the Android operating system and will be rolled out on iOS and in additional target markets in FY 2022, with new equities and ETFs to be added to the product offering. This will help to drive further the expansion of the Group’s product range and geographic footprint in the future.