Online broker eToro is changing the pricing model for crypto trading.

The company explains that its clients communicated to it that they were dissatisfied with its crypto prices. As a result of this, eToro decided to take action to make the costs of trading cryptoassets on eToro more transparent.

By changing the pricing model for cryptoasset trading, eToro is able to make it more competitive, reducing the cost for users for 49 out of the 55 cryptoassets eToro currently offers.

Previously, eToro charged a different spread amount for each cryptoasset, whenever users opened, and closed cryptoasset positions. Now, there’s a unified fixed fee of 1% when you open, and close any cryptoasset position, on top of the raw market spread (AKA Bid-Ask spread) — this is the difference between the BUY and SELL prices.

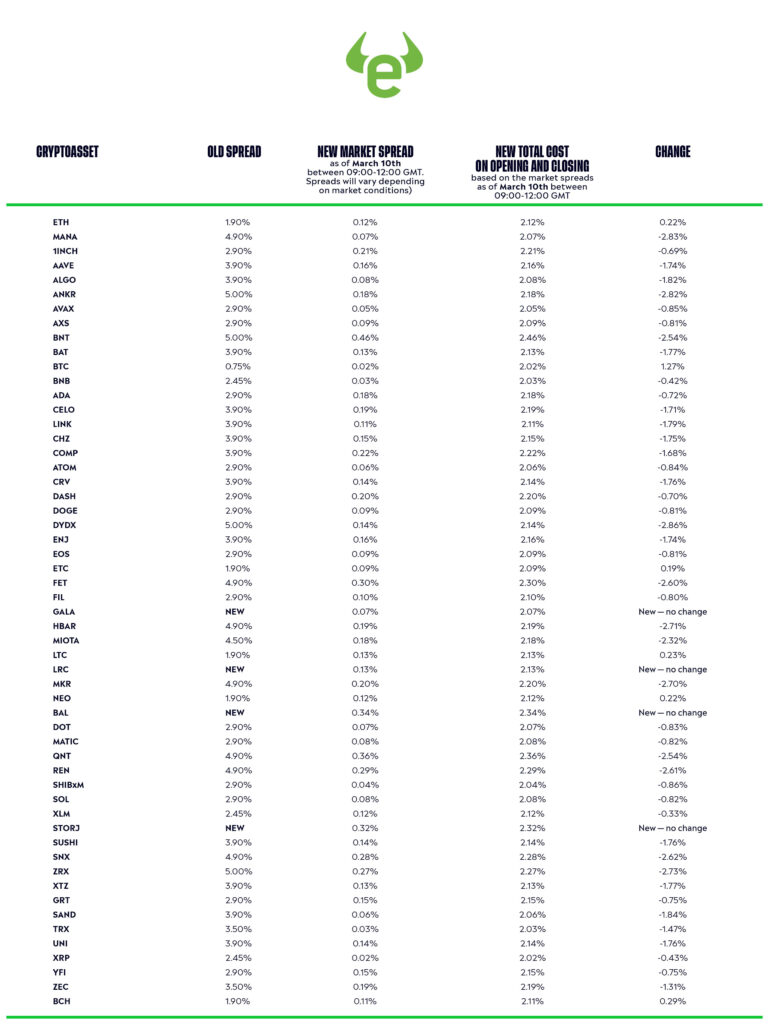

eToro has also created a table now indicating the change for each cryptoasset currently available on eToro. The table includes:

-

The name of the cryptoasset

-

The previous spread

-

The new Market spread (as of March 10th between 09:00-12:00 GMT. Spreads will vary depending on market conditions)

-

The new total cost on opening and closing based on the market spreads as of March 10th between 09:00-12:00 GMT

-

Percentage change

As soon as you open a new position, you will see an immediate “loss” which reflects this fee: the 1% cost of opening a crypto position, and the 1% expected cost of closing the position. When you close the position, the closing fee is adjusted to reflect the market price of the cryptoasset at the time of closing.

The broker has been regularly expanding its cryptoasset lineup. In February, for instance, eToro added several new tokens, including Avalanche and Hedera Hashgraph.