Following a very good start to the year in January and February, trading volumes at leading institutional FX trading venues continued to rise in March 2022, with a number of ECNs setting all-time (or close to it) records.

The continued volatility in financial markets as traders navigated the storm of war in Europe, soaring oil prices, and the specter of rising inflation made for a very active trading market in FX products during all of Q1-2022, and certainly during March.

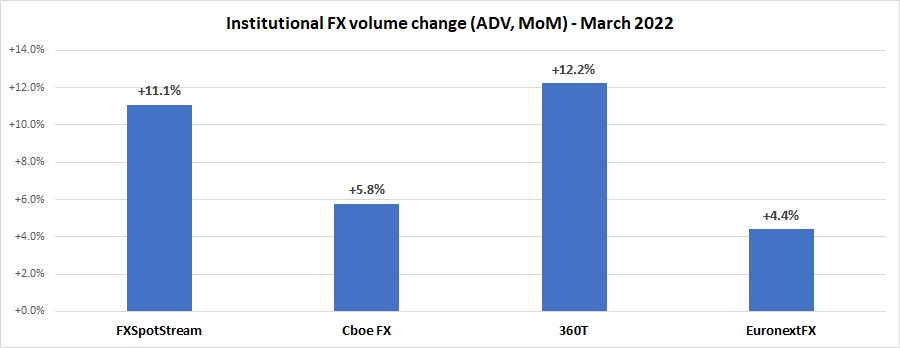

Each of the institutional ECNs surveyed – FXSpotStream, Cboe FX, EuronextFX and 360T – reported month-over-month increases for the third consecutive month, ranging from 360T’s 12.2% increase to an all-time record at FXSpotStream with an ADV of over $70 billion.

On average, trading volumes were up 8% MoM over February 2022.

Cboe FX (formerly HotspotFX)

- March 2022 average daily volumes were $44.44 billion, +5.8% from February’s $42.01 billion. This marks a second-best ever monthly result for Cboe FX.

EuronextFX (formerly FastMatch)

- March 2022 ADV $26.11 billion, +4.4% above February’s ADV of $25.01 billion.

FXSpotStream

- March proved to be a record month for FXSpotStream in terms of monthly ADV (USD70.115billion) and overall volume (USD1.613trillion).

- FXSpotStream’s ADV MoM (March‘22 vs February’22) increased 11.06%.

- FXSpotStream’s ADV YoY (March ‘22 vs March ‘21) increased 28.24%.

- FXSpotStream’s Overall Volume YoY (March ‘22 vs March ‘21) increased 28.24% to USD1.613trillion.

- FXSpotStream’s ADV YTD (Jan-March ’22) is USD62.313billion, an increase of 21.54% compared to the same period last year.

360T

- Average daily volumes (ADV) at 360T came in at $28.50 billion in March 2022, up 12.2% from February’s $25.40 billion.