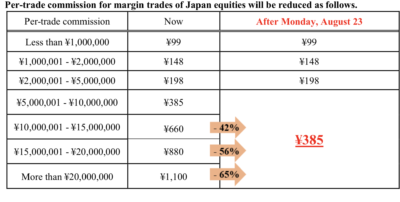

Monex, Inc, the Japanese online trading subsidiary of Monex Group, Inc (TYO:8698), today announced that per-trade commissions for Japanese equity margin trades of ¥1,000,000 or more will be reduced by up to 65%. The change is effective Monday, August 23, 2021.

Monex will lower per-trade margin trading commissions for orders of more than ¥1,000,000 to ¥385, which will make it easier for customers to trade domestic equities with smaller cost burden.

Monex offers a diverse range of ordering methods, trading tools such as “Monex Trader,” and data analysis tools such as “Stock Scouter”. All of these unique Monex services will continue to be offered in addition to the low margin trading commissions that are in line with other online securities companies.

Let’s recall that, in July, the broker announced that it was improving the trading conditions for buying odd-lot shares (stock units below the minimum lot shares) of Japanese stocks. The change, effective Monday, July 5, 2021, saw brokerage commissions for buying odd-lot share of Japanese stocks be made free of charge.

In November 2017 and November 2020, Monex lowered commissions for margin trades of Japanese equities, and in April 2021, Monex expanded its number of stocks for general margin selling to more than 2,000 equities.