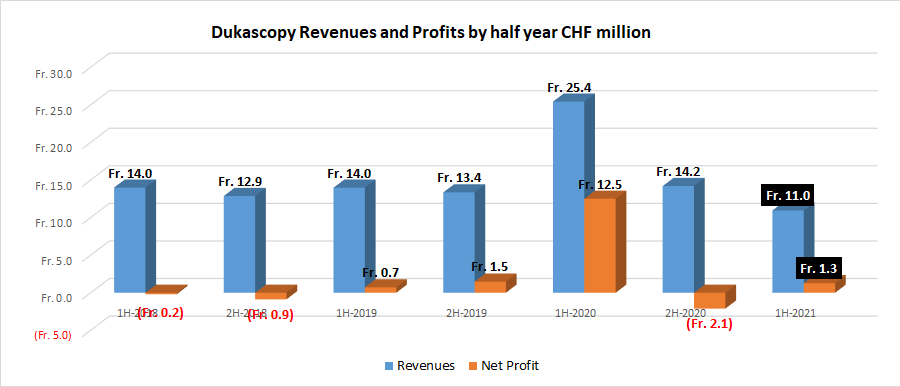

FNG Exclusive… FNG has learned from filings that Geneva based Retail FX broker Dukascopy Bank SA has seen a severe and continued drop-off in activity, with first-half 2021 revenues being the company’s lowest result in several years.

Revenues at Dukascopy (or what the company terms “Result from trading activities”) came in at CHF 10.95 million (USD $11.9 million) for the first six months of 2021, down 23% from the second half of 2020 and less than half the CHF 25.44 million that the company brought in during 1H-2020.

First half 2021 profit at Dukascopy was CHF 1.3 million (USD $1.4 million), better than the CHF 2.1 million loss the company suffered in 2H-2020 but well below the CHF 12.5 million in net income earned in the first six months of last year.

Despite the fall in activity Dukascopy did see client deposits continue to rise, hitting CHF 111.9 million as at June 30, 2021, up from CHF 96.1 million at year end 2020.

Like many Retail FX shops, Dukascopy saw a spike in client trading – and resulting revenues and profitability – at the outset of the COVID-19 pandemic in late Q1-2020 and into early Q2. But in the second half of 2020 the momentum dried up, and revenues were back at roughly pre-pandemic levels, and have now dropped even further.

Partly responsible for the drop, in our view, is that Dukascopy was somewhat late to the game in offering crypto trading to its clients. Dukascopy launched live crypto trading on MT4 just late in Q2. Results we’ve seen from brokers such as eToro highlight that crypto trading has been a big activity and revenue generator for Retail FX brokers in the first half of this year, and in particular during Q2-2021.

Dukascopy is the second largest Retail FX firm based in Switzerland after Swissquote, which continued to post record results into the first half of 2021.

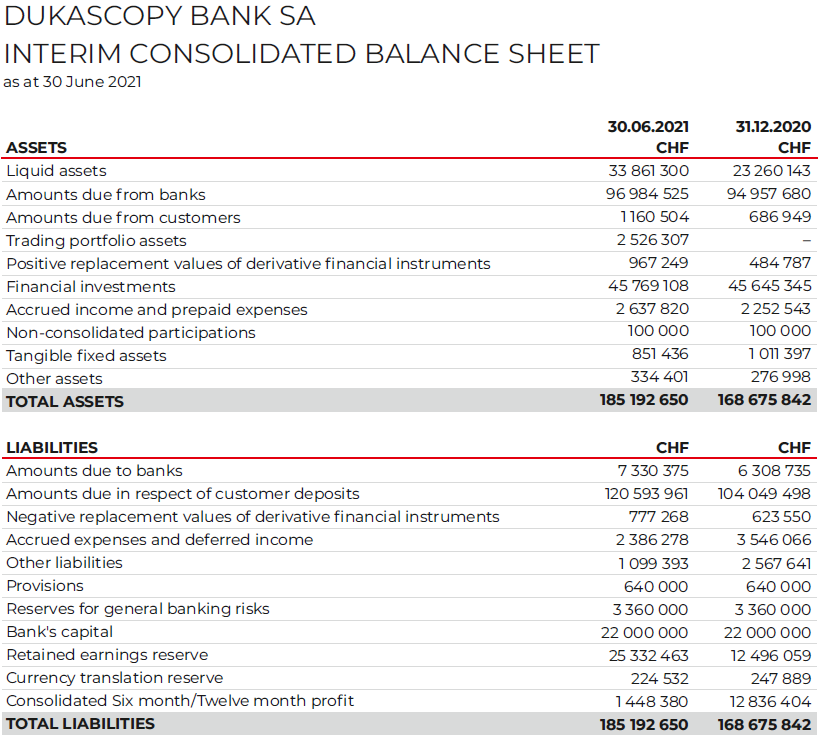

Dukascopy’s 1H-2021 income statement and balance sheet follow: