Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its key performance metrics for August 2021.

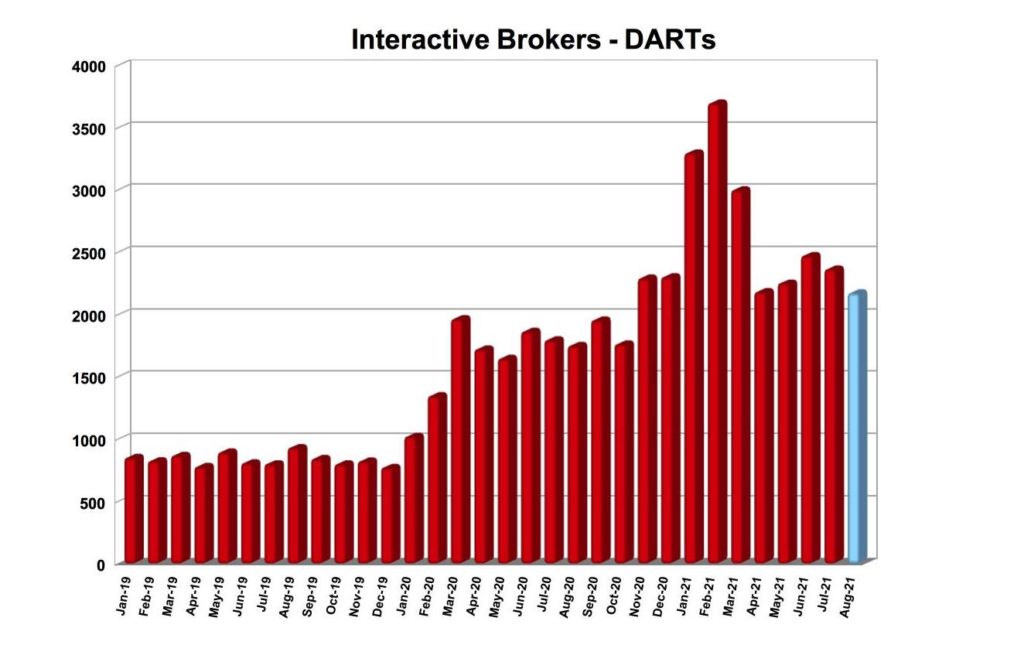

The broker reported 2.170 million Daily Average Revenue Trades (DARTs) for August 2021, 24% higher than prior year and 8% lower than prior month.

Ending client equity amounted to $364.6 billion, 53% higher than prior year and 4% higher than prior month, whereas ending client margin loan balances were $49.7 billion, 63% higher than prior year and 4% higher than prior month.

Interactive Brokers reported 1.49 million client accounts, 57% higher than prior year and 3% higher than prior month.

Let’s recall that Interactive Brokers posted net revenues pf $754 million for the second quarter of 2021, up from net revenues of $539 million in the equivalent period a year earlier. The result, however, lagged behind the one registered in the first quarter of 2021.

Income before income taxes was $541 million in the April-June 2021 period, compared to income before income taxes of $222 million for the same period in 2020.

Adjusted net revenues were $650 million and adjusted income before income taxes was $437 million for this quarter, compared to adjusted net revenues of $523 million and adjusted income before income taxes of $310 million for the same period in 2020.

During the second quarter of 2021, commission revenue increased $31 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes within an active trading environment.

Net interest income increased $78 million, or 40%, from the year-ago quarter on higher margin loan balances and strong securities lending activity.