Interdealer broker TP ICAP Group plc (LON:TCAP) today posted its financial and interim management report for the six months ended 30 June 2021 (H1 2021). The results are in line with those provided in a recent trading update.

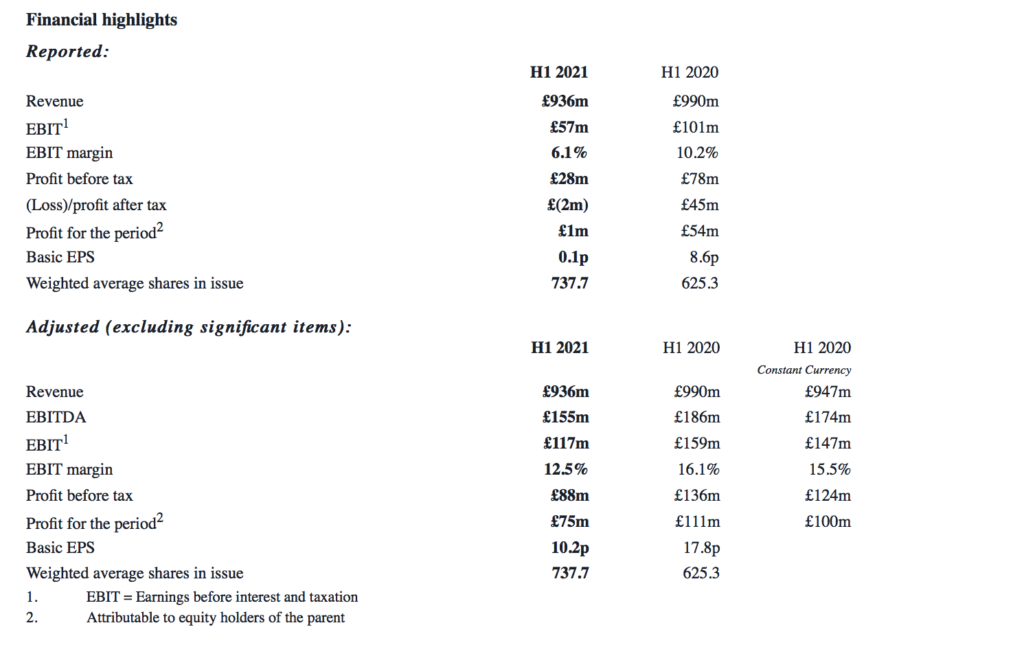

The Group’s performance was attributed to challenging trading conditions. In the first six months of 2021, TP ICAP delivered revenues of £936 million, down 1% on a constant currency basis (5% lower on a reported basis) against the comparative period, which included an outlying record first quarter.

Against the more normalised conditions of the first half of 2019, the Group’s revenue excluding Liquidnet were up 6% on a constant currency basis and 2% on a reported basis. Excluding Liquidnet’s revenue of £55m, revenue in the Period was 7% lower than the prior year on a constant currency basis (11% lower on a reported basis).

Adjusted operating costs increased 2% on a constant currency basis (or 2% lower on a reported basis). This increase largely reflected the Liquidnet acquisition. Total operating costs decreased 1% on a reported basis.

Excluding the Liquidnet acquisition, the Group’s management and support costs increased by 1% on a constant currency basis (but were 2% lower on a reported basis).

Adjusted EBIT for the half was £117 million, 26% lower than the prior year on a reported basis primarily due to reduced revenues in Global Broking and Energy & Commodities. Adjusted EBIT margin was at 12.5%, down from 16.1% in H2 2020, and we reported an adjusted profit before tax of £88m.

Reported EBIT was £57m, 44% lower than the prior year, with a reported EBIT margin of 6.1% (H1 2020: 10.2%).

Basic adjusted earnings per share (‘EPS’) were 10.2p (H1 2020: 17.8p) and we will pay an interim dividend of 4.0p (H1 2020 reported: 5.6p, H1 2020 pro-forma for the bonus element of the February 2021 rights issue: 4.0p) per share for the half year.

Revenue for the EMEA region was £456 million, a 5% reduction in constant currency (7% in reported currency) against the comparative period. This performance reflected slower markets in Global Broking and Energy & Commodities against a very strong revenue performance in H1 2020. This was partially offset by continued strong performance in Parameta Solutions and good growth in Agency Execution.

The Americas reported revenue of £307 million for the half, down 12% in constant currency (19% in reported currency). Subdued markets saw reduced revenues in Global Broking, E&C and Agency Execution, with Parameta Solutions growing 6% in the Period.

In Asia Pacific, revenue was marginally down against the comparative period at £118 million in reported currency (£121m in constant currency) which was a good performance given how hard the area has been affected by the pandemic. While Global Broking experienced reduced revenues, Energy & Commodities saw very strong growth in the Period as it opened new desks in both Tullett Prebon and ICAP.

Liquidnet revenues were £55 million, from 23 March 2021 to 30 June 2021.

With regard to Brexit, despite the ongoing complications caused by COVID, TP ICAP says it is executing its plans, which include leveraging its EU network, as well as hiring locally in Continental Europe.

“We expect to have the required number of brokers based in the EU before the end of the year. As a result, we continue to cover our EU clients effectively,” TP ICAP says.

A 4.0p per share interim dividend (H1 2020 interim dividend reported: 5.6p, 2020 pro-forma for February 2021 rights issue using the current 780.6m shares in issue: 4.0p) will be paid on 5 November 2021 to shareholders on the register at close of business on 1 October 2021.

In terms of 2021 full year guidance and outlook, TP ICAP notes that trading activity in July and August 2021 is broadly in-line with the prior year.

TP ICAP forecasts:

“Despite the subdued trading conditions we have experienced in the Period, together with continuing uncertainty caused by quiet markets and the disruption from COVID-19, we anticipate full-year revenue for the Group, excluding Liquidnet, to be broadly in line with 2020 on a constant currency basis”.