The Australian Securities & Investments Commission (ASIC) today published a report on its licensing and professional registration activities for the 2020–21 financial year, that is, the period from July 2020 to June 2021.

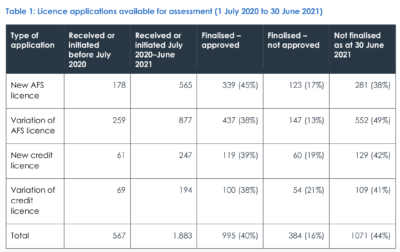

In the 2020–21 financial year, ASIC received significantly more new and variation AFS and credit licence applications (1,883) compared to the previous financial year (1,346). The increase relates mostly to requirements for new persons or entities to hold an AFS or credit licence or additional authorisations.

More AFS and credit licence applications were withdrawn or refused – a total of 392 against 365 in the previous financial year.

ASIC achieved 797 additional regulatory outcomes for AFS and credit licences (e.g. imposition of a key person condition or changes to authorisations), compared to 741 in the previous financial year.

Out of 741 new AFS license applications assessed, 339 new AFS licences were granted.

Let’s note that, since 1 April 2020, foreign financial services providers (FFSPs) from certain jurisdictions seeking to provide financial services to only wholesale clients have been able to apply for an AFS licence under a streamlined licensing assessment process.

In May 2021, the Government announced that it would consult on reforms to the regulatory regime for FFSPs. As a result, ASIC has extended the transitional arrangements from 31 March 2022 to 31 March 2023 in relation to FFSPs that can rely on an exemption from having to hold an AFS licence.

ASIC will continue to assess FFSP applications on a streamlined basis until any changes are made in response to the Government’s FFSP reform proposals.

The regulator says it is aware that the broader economic impact of the COVID-19 pandemic has affected some applicants’ intended commencement dates. Although the law enables ASIC to cancel a licence when a licensee has not commenced operation within six months of the licence being granted, as at 30 June 2021 ASIC had extended this period for 27 licensees due to pandemic-related issues.

However, ASIC is still examining notifications of commencement and will take action when it is warranted.

Applicants should note that the assessment of licensing applications is not an automatic process; each application is subject to a risk rating and assessed on its particular facts.

When ASIC assesses applications, there are a number of factors that can affect how long it takes for the assessment to take place. These include:

- the quality of the application, and any additional information requested

- the complexity of an applicant’s business model and the authorisations sought

- any adverse intelligence in relation to the applicant or its relevant personnel

- competing ASIC priorities and the volume of applications under consideration.

As a result of the large number of applications received in May and June 2020 relating to the insurance claims handling and debt management services reforms, the volume of applications under assessment is currently relatively high. This may delay the assessment of some applications in 2021–22.