Multi-asset investment company Saxo Bank continues to grow its lineup of equity theme baskets. The latest addition is Saxo’s basket on 3D printing companies.

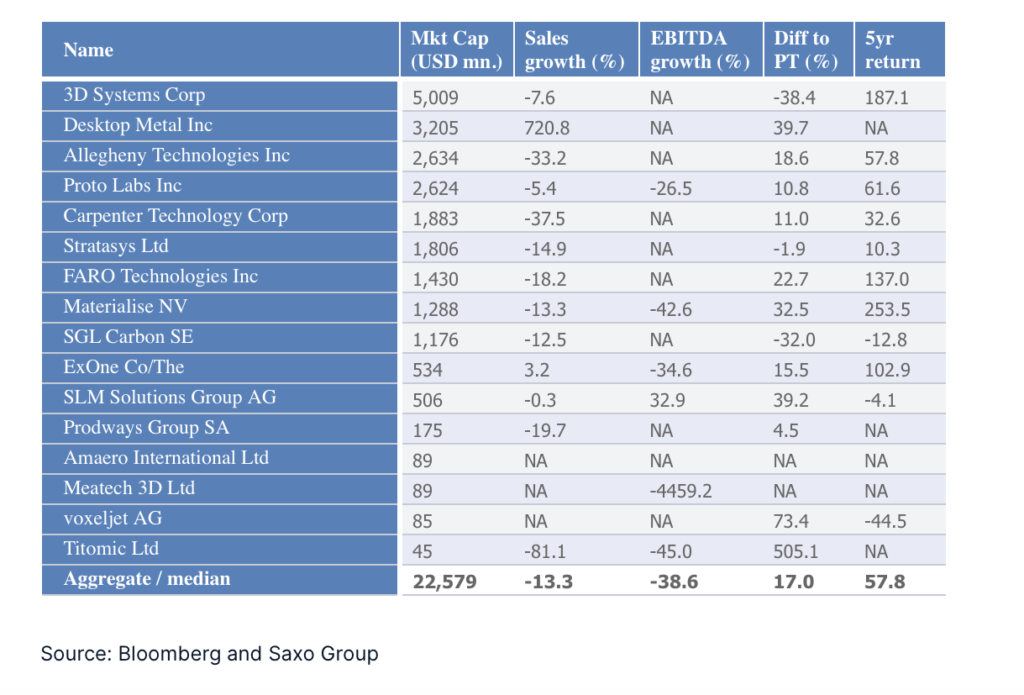

This is the smallest basket Saxo has done so far with only 16 companies making the cut.

Saxo’s Head of Equity Strategy Peter Garnry explains:

“We want our baskets to provide as pure exposure as possible to a theme and thus our theme basket is much narrower than the available 3D printing ETFs in the market”.

The 3D printing industry has experienced a lot of ups and downs since the late 1980s with the consumer hype period around 2013 burning a lot of investors causing sustained suspicion over the future of 3D printing. Mr Garnry says.

In terms of risks, he notes that valuations are high and many of the companies in Saxo’s basket are small and some have almost no revenue. This means that this is a very high-risk theme despite a potentially promising future.

Another risk for investors is that large industrial firms create in-house additive manufacturing capabilities due to the need of deep integration into existing manufacturing processes and that the companies in the basket thus will not capture the value of 3D printing.

Last month, Saxo introduced its 16th equity basket – it focuses on the cyber security industry. Prior to that, Saxo launched an equity theme basket which provides a diversified exposure to the global logistics industry.