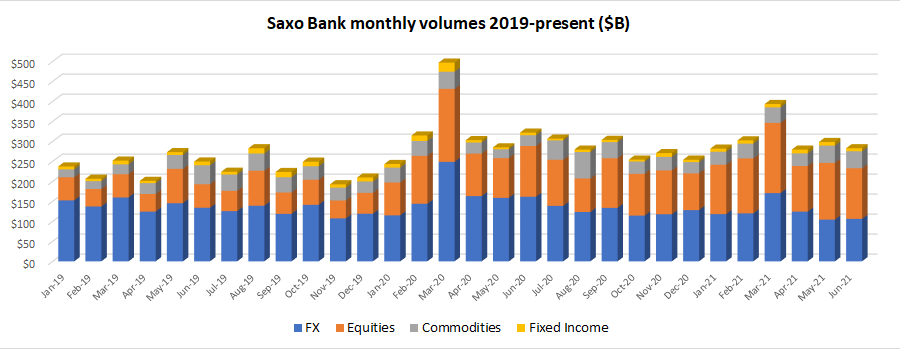

Copenhagen’s Saxo Bank has closed out its first half of 2021 with yet another weak month of client trading volumes, with June’s activity of $282.8 billion down 5% MoM from May’s $298.6 billion.

Saxo once again had one of its slowest months over the past 5+ years in its core FX trading business, with FX trading volumes coming in at $106.1 billion (although that was up slightly from May’s $104.3 billion). Equities trading was off 11% MoM to $126.7 billion, Commodities were down 2% to $42.6 billion, and Fixed Income fell 18% to $7.4 billion.

Saxo Bank averaged total monthly trading volumes of $287 billion in Q2-2021, down 12% from Q1’s $326 billion. In 2020 Saxo averaged $303 billion in monthly client trading volumes.

Saxo Bank recently launched crypto trading in a few geographies (Singapore, Australia, MENA) with a limited BTC, ETH and LTC offering, as was first exclusively reported by FNG – however it seems as though crypto trading hasn’t really made a dent yet in the company’s overall volumes. The company also made some recent management changes in Saxo Bank’s Hong Kong and China operations, a key focus area for Saxo now that it is controlled by Chinese investor Geely Group. Saxo also just named a new CFO from outside the FX industry, Mette Ingeman Pedersen.