The Australian Securities and Investments Commission (ASIC) today published its Corporate Plan 2021-25, outlining its priorities over the next four years.

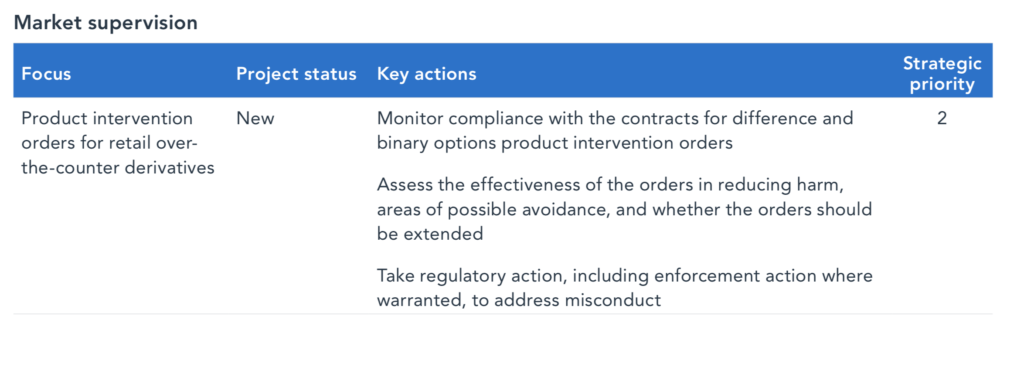

The product intervention orders for CFDs and binary options which took effect earlier in 2021 are among the foci for the regulator.

ASIC affirms that it will:

- Monitor compliance with the contracts for difference and binary options product intervention orders;

- Assess the effectiveness of the orders in reducing harm, areas of possible avoidance, and whether the orders should be extended;

- Take regulatory action, including enforcement action where warranted, to address misconduct.

The regulator says it will continue to use its regulatory tools to improve consumer outcomes (including product intervention orders where there is a significant risk of consumer detriment). It will also continue to assess applications for Australian financial services (AFS) licences, Australian credit licences (credit licences), and professional registrations (e.g. as company and self-managed superannuation fund (SMSF) auditors), and manage registered liquidators registrations.

In March 2021, ASIC confirmed that its product intervention order imposing conditions on the issue and distribution of contracts for difference (CFDs) to retail clients took effect.

As FX News Group has reported, ASIC’s order reduces CFD leverage available to retail clients and targets CFD product features and sales practices that amplify retail clients’ CFD losses, such as providing inducements to become a client or to trade. It also brings Australian practice into line with protections in force in comparable markets elsewhere, such as Europe.

The maximum CFD leverage available to retail clients now ranges from 30:1 to a 2:1, depending on the underlying asset class. Before, a retail investor’s CFD exposure could be as much as 500 times their original outlay.