Bank of America Corp (NYSE:BAC) has just reported its financial metrics for the third quarter of 2021, with the Global Markets segment delivering a solid set of results.

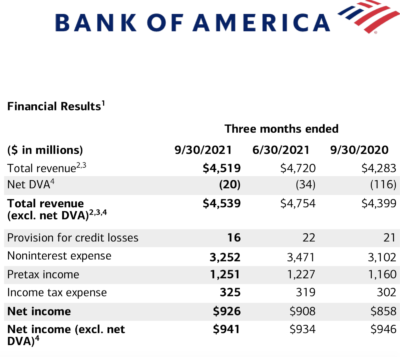

Global Markets net income increased $68 million to $926 million, with revenues growing modestly faster than expenses. The result was better than in the preceding quarter. Excluding net DVA, net income decreased 1% to $941 million.

The segment posted revenue of $4.5 billion, up 6% from the year-ago period, driven by higher sales and trading results. Excluding net DVA, revenue increased 3%.

Sales and trading revenue increased to $3.6 billion. Excluding net DVA, sales and trading revenue increased 9% to $3.6 billion.

FICC revenue decreased 5% to $2.0 billion, driven by a weaker trading environment for mortgage and interest rate products, partially offset by improved client flows in foreign exchange.

Equities revenue increased 33% to $1.6 billion, driven by growth in client financing activities, a stronger trading performance and increased client activity.

Across all segments, net income rose 58% to $7.7 billion, or $0.85 per diluted share. Revenue, net of interest expense, increased 12% to $22.8 billion.

Chairman and CEO Brian Moynihan commented:

“We reported strong results as the economy continued to improve and our businesses regained the organic customer growth momentum we saw before the pandemic. Deposit growth was strong and loan balances increased for the second consecutive quarter, leading to an improvement in net interest income even as interest rates remained low.

For our shareholders, we returned nearly $12 billion in capital this quarter, while continuing to support clients and communities. The team has done a remarkable job, and I couldn’t be prouder of how they stepped up to support our clients and deliver another quarter of outstanding results.”