Shares of leading UK online broker CMC Markets plc (LON:CMCX) traded down by about 6% early Wednesday, after the company released its results for the first half of Fiscal 2022 (CMC has a March 31 fiscal year end).

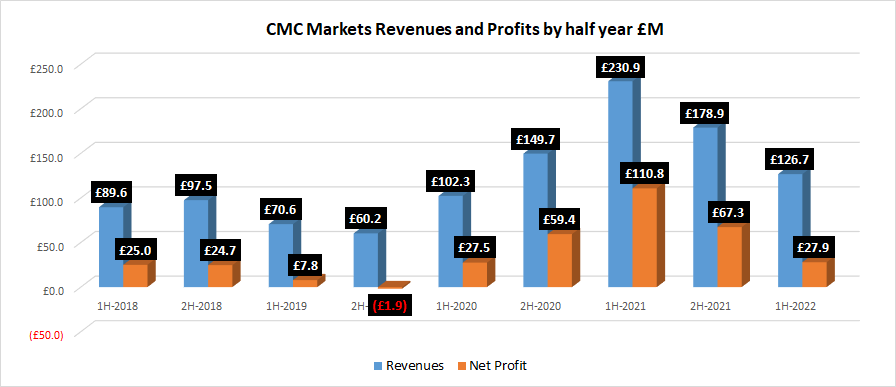

CMC Markets reported Revenues (or what it terms Net Operating Income) of £126.7 million for the six month period ended September 30, 2021, which was down by 23% from the previous 6-month period and off by nearly half (45%) from a year ago in 1H-2021. Profits were also down sharply, by 36% from the previous six months and by 75% from last year.

However the decline in activity did not really come as a shock to markets, which was basically prepared for the drop-off after CMC issued a trading update in early September indicating that things were going much more slowly in FY2022 than the previous year. That led to a steep, one-day share price decline of 27% for CMC, and its shares have continued to drift further downward ever since.

What seems to have “irked” the markets today, leading to the small but still significant drop in share price, is that the company kept its early-September revenue guidance in place for Revenue of between £250-280 million for all of FY2022, while expecting operating expenses to be moderately higher year-on-year, circa 6% higher than H1 2022.

CMCX shares did recover somewhat earlier this week, after the company confirmed our weekend report that CMC Markets is looking to split itself into two publicly traded entities, one which will keep the “legacy” leveraged trading and spreadbetting business, and the other for stockbroking and investment management.

CMC Markets share price graph past six months. Source: Google Finance.