Euronext NV (EPA:ENX) today posted its results for the second quarter of 2021, with FX trading revenue lower than a year earlier.

FX trading reported revenue amounted to €5.7 million in Q2 2021, down 13.5% from the equivalent quarter in 2020, reflecting lower FX trading volumes in a low volatility environment. The result is also lower than the €6.1 million of revenue registered in the first quarter of 2021.

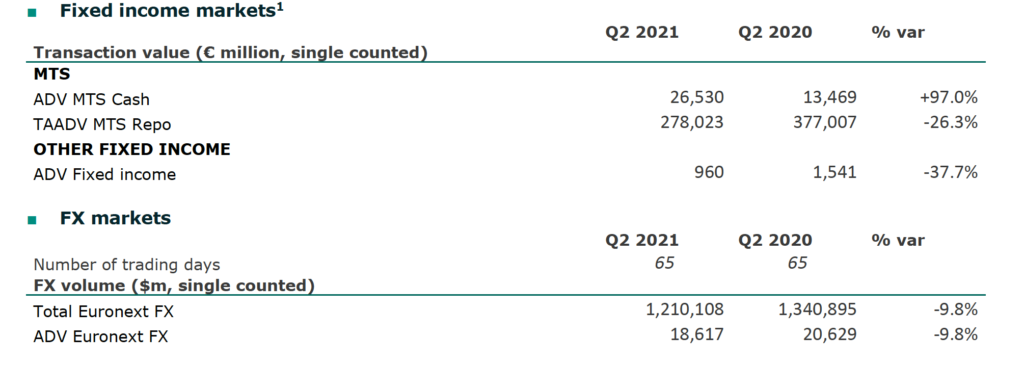

Over the second quarter of 2021, US$18.6 billion average daily volumes were recorded, down 9.8% compared to the year-ago quarter.

On a like-for-like basis at constant currencies, Spot FX trading revenue was down 5.3% in Q2 2021 compared to Q2 2020.

Trading revenue grew to €112.8 million, up 26.1% from a year earlier, primarily driven by the consolidation of Borsa Italiana capital markets and robust yield. Fixed income trading revenue increased to €17.3 million, driven by double-digit growth in MTS cash trading activities.

Listing revenue grew to €48.2 million (+33.6%), resulting from record listing activity for equities with 62 new listings, and for ETFs, together with the continued growth of Euronext Corporate Services, and the consolidation of the Borsa Italiana Group.

Advanced Data Services revenue grew to €46.5 million (+29.7%) due to resilience of core activities and the consolidation of the Borsa Italiana Group.

EBITDA amounted to €192.9 million (+€67.5 million, +53.8%).

Reported net income, share of the Group, reached €86.6 million, up 5.6% from a year earlier.