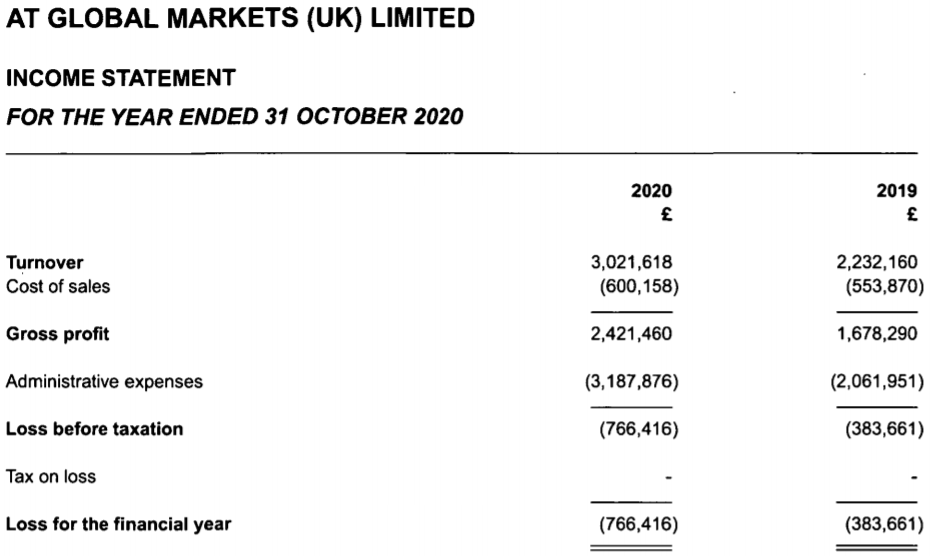

FNG Exclusive.. FNG has learned that ATFX UK (or more formally AT Global Markets UK Limited), the FCA regulated arm of Chinese controlled retail FX broker ATFX, posted a loss of £766,416 for the fiscal year ended October 31, 2020.

The principal activity of the company is the provision of online trading facilities in Forex and Contracts for Difference (CFDs) to Retail and Professional clients.

ATFX UK noted that it saw trading volumes and revenue increase significantly in the early part of 2020, and expanded activities during the year with the development of the ATFX Connect brand, an institutional offering to Professional clients with new technology and deep liquidity. The company also invested in enhancing marketing channels. The expansion and development has resulted in an increase in administration costs, leading to the 2020 loss despite increased revenues.

The company issued £4,650,000 of shares during the year, raising additional capital from other Group companies. The company had net assets of £6,336,206 (2019: £2,452,622) which included £5,775,948 of cash balances. Accordingly the company said that it has a strong balance sheet and is well placed to achieve its long term strategy.

Key performance indicators are revenue of £3,021,618 (2019 £2,232,160) an increase of 35% and net assets of £6,336,206 (2019 £2,452,622) an increase of 158%. The increase in net assets was due to the increase in share capital, as described above. The company made a loss of £766,416 (2019 loss £383,661).

ATFX has lost a number of senior executives in the UK and elsewhere over the past year, including Dan Lewis in institutional sales (now at IS Prime), head of project management Mike O’Sullivan (to INFINOX), MENA focused Ahmed Fouad (now at Leverate), institutional exec Ghadeer Ibrahim (to MultiBank), and Dubai based bus dev executive Mohamed Halim (now at TeraFX).

ATFX is controlled by Chinese entrepreneur Hiu Keung (Joe) Li. The group has licensed subsidiaries in the UK (FCA), Cyprus (CySEC), and Mauritius.

ATFX UK’s 2020 income statement follows: