FNG Exclusive… FNG has learned via regulatory filings that OANDA Europe Limited, the London based, FCA regulated arm of Canada based Retail FX brokerage group OANDA, saw a nice rebound in activity and a return to profitability in 2020, following a disappointing 2019 at OANDA.

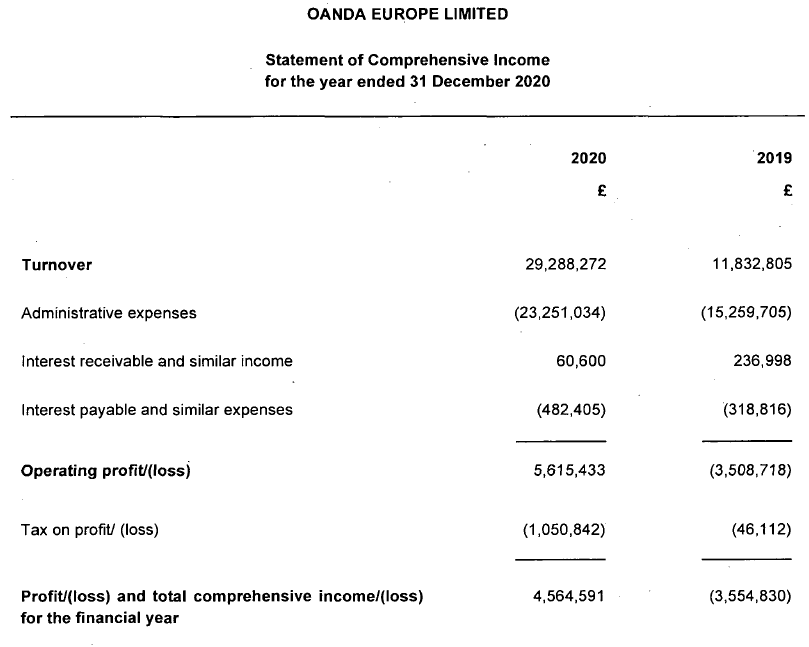

OANDA Europe posted revenues of £29.3 million in 2020, up 148% from £11.8 million in 2019. The company posted net profit of £4.6 million in 2020 after suffering a loss of £3.6 million the previous year.

Despite the increase in activity, OANDA Europe saw a drop in client funds held by the firm, to £38.1 million as at 31/12/2020 versus £42.8 million in 2019.

After blaming its poor 2019 performance on the then-newly imposed ESMA leverage limits, OANDA said that for 2020 it had in mind five key milestones (i) to return the business to profitability, (ii) increase the size of the active client base, (iii) revamp the product offer, (iv) tightly control the cost base, and (v) ensure the business continues to meet its regulatory and legal obligations. Achieving some of those milestones were aided by the COVID-19 pandemic, which brought with it heightened volatility resulting in a rise in new customers, higher levels of reactivation of dormant clients, and increased trading activity from existing clients leading to a significant increase in trading revenue for the reporting period.

For 2021, OANDA said that its key objectives are to continue to deliver profitable earnings whilst maintaining effective risk, expense management and regulatory compliance. This will be achieved by continuing to grow its active client base in the UK, evolving the product offering, and maintaining a tight control on costs.

OANDA Europe is an online margin trading business that provides leveraged trading for contracts for difference (CFDs) and spreadbets on foreign currencies, bonds, commodities and indices. This business is conducted primarily through OANDA’s proprietary trading platform FxTrade, a fully automated trading platform which is owned by OANDA Corporation, as well as MetaQuotes’ MT4 platform. The company economically hedges all its exposure with related OANDA entities immediately upon the execution of a client trade to make sure it does not take on any market risk associated with that position. The company currently hedges with OANDA Australia Pty Ltd, and OANDA (Canada) Corporation ULC.

OANDA is controlled by private equity investment firm CVC Capital Partners.

OANDA Europe’s 2020 income statement follows: