The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

On February 24, we woke up to news of Russia’s full-scale invasion of Ukraine. Peace talks had failed, and Russian forces were entering the southern Ukrainian city of Kherson and continuing to shell Kyiv and Kharkiv. It’s a massive human tragedy and a geopolitical catastrophe. So, why are we talking about sanctions? It’s because sanctions are equally powerful weapons to influence a nation’s behaviour and decisions. Sanctions have been the foreign policy of choice in developed economies for years.

The international outrage against the war translated into sanctions from the US, the UK, Europe, and Japan, targeting the assets of Russia’s government and allies, their top officials, the Central Bank (CBR), and their largest financial institutions. Policymakers in western nations are also in the process of compiling a list of financial institutions to exclude from the SWIFT messaging system used to communicate cross border payments.

Where Eagles Won’t Dare!

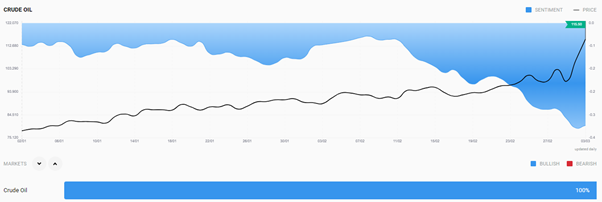

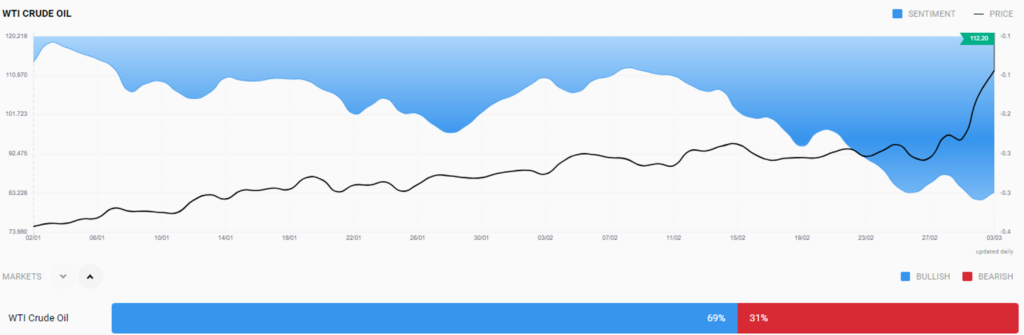

There have been calls in the European Parliament and the US Congress to impose sanctions on Russia’s oil and gas exports, on which its GDP heavily relies. However, energy-resource-based sanctions give policymakers the heebie jeebies. Let’s not forget that Russia is the world’s third-largest producer of oil, and such sanctions could leave the global economy flat on its feet.

Europe for example, depends on Russia for 25% of its oil and 40% of its gas supply. The ECB estimates a 10% gas rationing will shave 0.7% off the euro-area GDP. A complete freeze on Russia’s gas supply will trim the region’s GDP by 3%.

The Impact on Russian Markets

The sanctions have already significantly weakened the Russian economy. Its stock markets have been closed for the longest period since 1998 and domestic institutions are frantically accumulating cash to support the market at its reopening. The Ruble plummeted more than 25% in response to the sanctions, causing the Central Bank of Russia (CBR) to raise interest rates from 9.5% to 20% and institute capital controls, including a ban on foreign institutions selling off Russian assets. Sanctions also threaten the central bank’s access to their sizeable foreign currency reserves.

Russia isn’t the only one suffering. Here’s a look at the financial market impact of both actual and potential sanctions.

Commodities Inflation in the Global Markets

The Russian and Ukrainian economies make up only 2% of world GDP and global trade. However, the products they trade in have a direct impact on global markets. The countries are large exporters of oil, gas, food grains, fertilisers, and industrial metals. Sanctions are currently not targeted at these exports, as the world needs these crucial supplies. However, this has not stopped markets from reacting.

Fears around the Russian invasion causing more supply disruptions and logistical constraints have driven up food, oil, and metal prices. The global food markets are already under considerable pressure, following a 28% rally in prices in 2021 and uncertainty around weather conditions. The spike in food prices heightens inflationary winds worldwide.

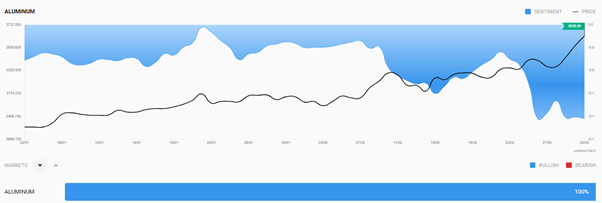

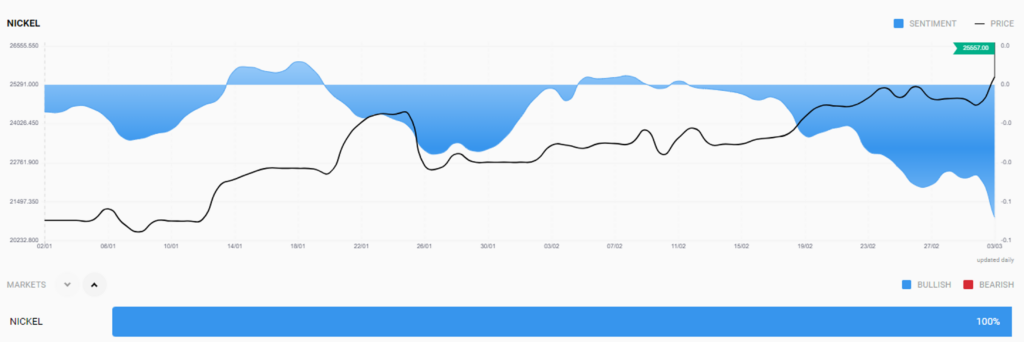

The metal markets are already in the grips of a supply shortage, reaching record prices in copper, aluminium, and nickel. Industrial metal prices are a headwind for economies trying to spur output to emerge from the pandemic effect.

Both WTI and Brent crude have surged past the $100 mark. Oil majors such as BP, Exxon and Equinor have announced exits of their Russian operations. Despite there being no oil-related sanctions, SEB Bank estimates that 70% of the 4.3 million barrels of Russia daily crude exports are already frozen. Oil’s inflationary effects will be felt globally. Despite oil prices surging, market sentiment for both Brent and WTI crude is overly positive, as can be seen on Acuity’s Sentiment Widget.

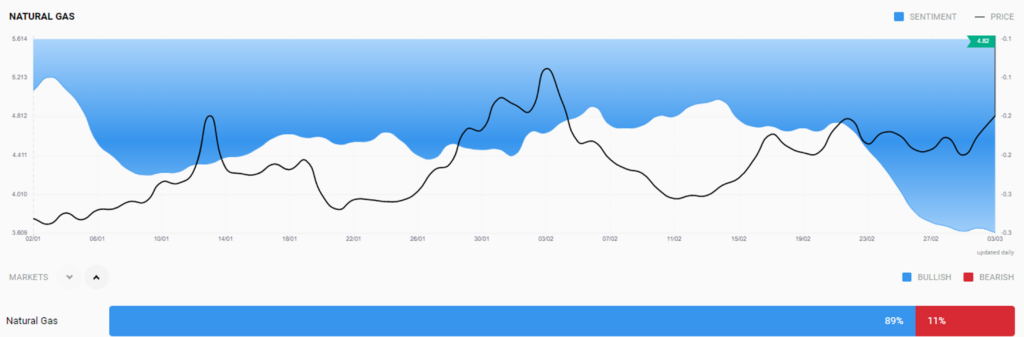

Physical gas supply has been relatively unhindered with strong supply even in pipelines running through Ukraine. European states have also emphasised that they have a sufficient gas stockpile to last winter. However, driven by uncertainty and expecting a significant reduction in supply, gas prices in Europe made new highs in March.

In the oil markets, Russia can offset some of the losses from any sanctions by diverting oil to China, which takes up 28% of its oil exports. Beijing has already shown a willingness to buy up Russian energy and agricultural supplies and has been vocal in its criticisms of sanctions. However, China’s assistance in the gas markets is limited as it only accounts for 1% of Russia’s exports.

Monetary and Fiscal Responses

The war and subsequent sanctions necessitate higher fiscal spending in the European economies. There are planned defence budget hikes from NATO members, led by an increase by Germany to 0.7% of its GDP. Staving off food insecurities and providing for war refugees may also require fiscal integration. This spending might divert funds from investments that spur growth. If it requires fiscal expansion, the immediate cash demand could drive up yields.

Before the invasion, monetary policy in the developed world was already turning hawkish due to record-setting inflation levels. After the invasion, there is some softening on this stance. The Fed has indicated a rate hike in March but reduced it from 50bps to 20bps, balancing inflation and growth objectives. Europe, where growth is more under threat, the ECB may push its December rate hike to early 2023 or beyond to prevent stagflation shocks while their essential commodities become costlier.

Safe Haven Assets

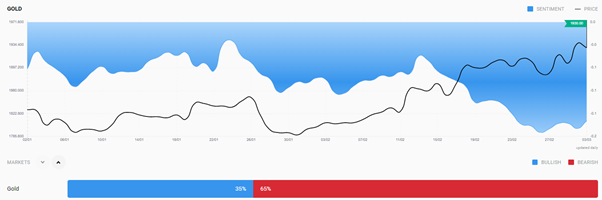

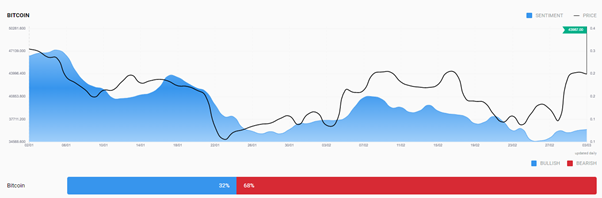

Amid the geopolitical tensions, there’s already been a flight to safety among investors. The US dollar, gold, and cryptocurrencies have recorded rallies, gaining through February due to mounting Russia-Ukraine uncertainty. Increasing certainty around sanctions and their results could lead investors to shed safe-haven assets. Market sentiments for gold and cryptos are already turning negative, according to Acuity’s Sentiment Widget.

Equity Markets

Equities have staged a more capricious response to sanction news. Although the major indices are still trading lower than the highs reached earlier this year, they have largely recovered the initial war-triggered losses. Equity markets already seem to have priced in a major portion of the invasion and sanction concerns, including their impact on growth. There is also a marked hedging move toward commodity equities.

While existing Russian sanctions have been targeted at Russian assets and other cash flow sources, a potential sanction on Russian exports can have a major impact on global financial markets, creating a rally in commodities markets. Russia’s retreat could see a reversal in many of the effects, possibly faster than when they began.