Intercontinental Exchange (NYSE:ICE), a leading global provider of data, technology and market infrastructure, today reported financial results for the second quarter of 2021.

For the quarter ended June 30, 2021, consolidated net income attributable to ICE was $1.3 billion on $1.7 billion of consolidated revenues, less transaction-based expenses. Second quarter GAAP diluted earnings per share (EPS) were $2.22. Adjusted net income attributable to ICE was $657 million in the second quarter and adjusted diluted EPS were $1.16.

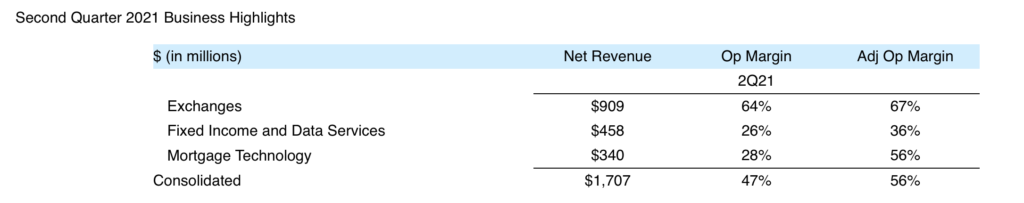

Second quarter consolidated net revenues were $1.7 billion, up 22% year-over-year including exchange net revenues of $909 million, fixed income and data services revenues of $458 million and mortgage technology revenues of $340 million.

Consolidated operating expenses were $908 million for the second quarter of 2021. On an adjusted basis, consolidated operating expenses were $744 million. Consolidated operating income for the second quarter was $799 million and the operating margin was 47%. On an adjusted basis, consolidated operating income for the second quarter was $963 million and the adjusted operating margin was 56%.

- Second quarter exchange net revenues were $909 million.

- Second quarter fixed income and data services revenues were $458 million.

- Second quarter mortgage technology revenues were $340 million.

ICE declared a $0.33 per share dividend for the third quarter of 2021, which is up 10% from the $0.30 per share dividend paid in the third quarter of 2020. The cash dividend is payable on September 30, 2021 to stockholders of record as of September 16, 2021. The ex-dividend date is September 15, 2021.