Trading volumes at leading institutional eFX venues finished off the first half of 2021 with a bang in June, continuing a fairly strong trend in trading volumes which began at the outset of the COVID-19 pandemic nearly a year and a half ago.

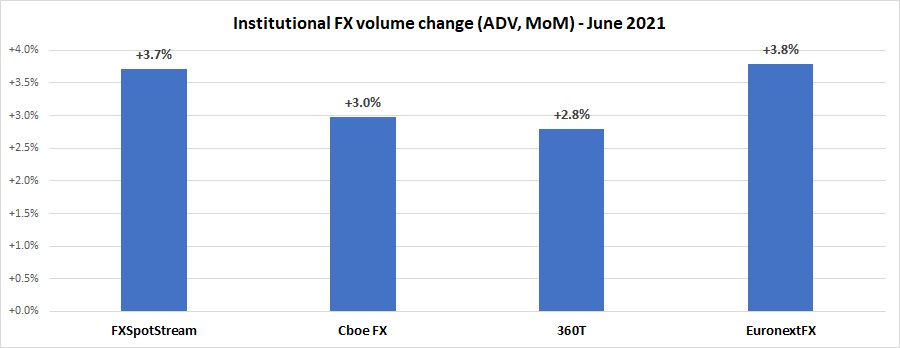

Interestingly, nearly all the institutional platforms and ECNs tracked – EuronextFX, Cboe FX, FXSpotStream, and Deutsche Borse’s 360T – saw virtually identical 3% MoM moves up in volumes as compared to May (details and data below).

But more competition is coming.

TP ICAP recently announced plans for a new Spot FX eMatching platform, SpotMatch. And venture capital titan Sir Ronald Cohen is backing another multi-bank FX marketplace called MillTechFX, already operating in build mode for the last 12 months.

Cboe FX (formerly HotspotFX)

- June 2021 average daily volumes were $33.5 billion, +3.0% MoM.

EuronextFX (formerly FastMatch)

- June 2021 ADV $19.35 billion, +3.8% above May’s ADV $18.66 billion.

FXSpotStream

- In June FXSpotStream posted an ADV of USD49.091billion, an increase of 3.71% MoM vs May ‘21 and the 3rd highest ADV in FXSpotStream’s history

- FXSpotStream’s ADV MoM (June ‘21 vs May ‘21) increased 3.71% to USD49.091billion

- FXSpotStream’s ADV YoY (June ‘21 vs June ‘20) increased 13.41% to USD49.091billion

- FXSpotStream’s Overall Volume MoM (June ‘21 vs May ‘21) increased 8.65% to USD1.080trillion, crossing the USD1 trillion mark for the 4th time in the company’s history

- FXSpotStream’s ADV YTD (Jan-June ‘21 vs Jan-June ‘20) increased 14.7% to USD49.810billion when compared to the same period last year

360T

- Average daily volumes (ADV) at 360T came in at $22.0 billion in June, up 2.8% from May’s $21.4 billion.