Electronic trading major Interactive Brokers continues to enhance the capabilities of its TWS platform. The latest (beta) build of the solution enables harvesting capital losses via the Allocation Order Tool.

Financial Advisors can help clients realize tax benefits of capital loss using the Allocation Order Tool. Users can preview potential losses on stocks, and pre-allocate lots for all or multiple accounts to harvest these capital losses.

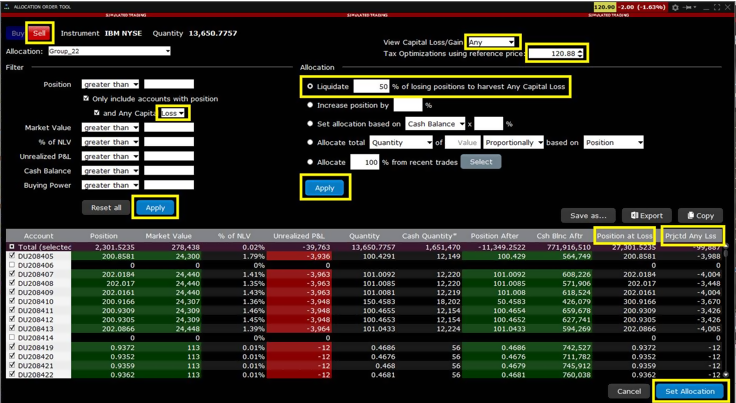

To use this feature, select an asset with an expected loss, for example a long or short position with negative unrealized P&L, or a long or short position that has an average price higher/lower than the expected price to liquidate the position. Open the Allocation Order tool to see the list of accounts invested in the asset.

Complete fields as shown below:

Remember to “Apply” Filters and Allocation details. Select accounts as desired, and click Set Allocation to save the order.

From the Orders panel in your Portfolio, modify as needed then transmit the order. Note that if the order does not fill completely or if you close only a portion of positions, Interactive Brokers will apply lots that maximize your capital loss. Verify lot allocations the next trading day after the order fills in the Reports tab in Client Portal.

Let’s note that the broker has recently released a new version (10.11) of its TWS platform, with a raft of new features available to users of the solution. In the latest release, Interactive Brokers has added many new Risk Measure columns to the Risk Navigator. Columns can be added to tables using the Metric menu.

The latest release of the platform also offers enhanced technical analysis with Trading Central.

Trading Central content has been added to Fundamentals Explorer in TWS, providing more technical analytics to help traders better identify trading opportunities. To access Trading Central analytics, open Fundamentals Explorer and use the Analyst Ratings, Technical Insights and Value tabs.

Traders can also use the Analyst Ratings tab to access Trading Central Analyst Views. This offers a combination of senior analyst expertise plus automated algorithms.