Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) today posted its key operating metrics for June 2021.

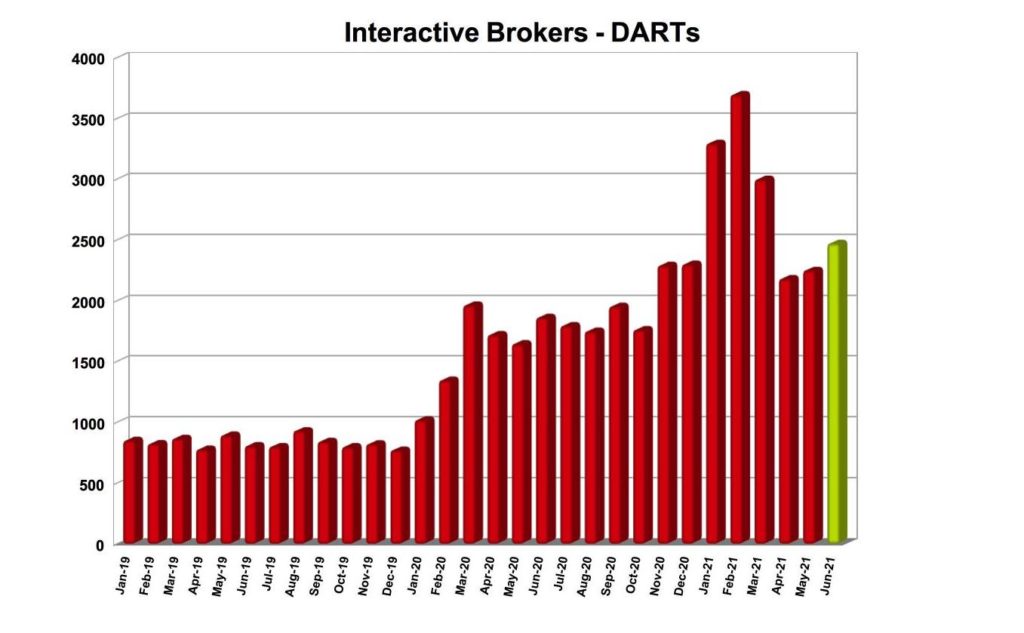

The company registered 2.471 million Daily Average Revenue Trades (DARTs) in June 2021, 33% higher than prior year. The result is 10% higher than the 2.250 million DARTs registered in May 2021.

Ending client equity amounted to $363.5 billion, 79% higher than prior year and 4% higher than prior month, whereas ending client margin loan balances of $48.8 billion, 96% higher than prior year and 7% higher than prior month.

Interactive Brokers reported 1.41 million client accounts at the end of June 2021, 61% higher than in June 2020 and 2% higher than in May 2021.

Let’s recall that, in the first quarter of 2021, increased market volatility pushed Interactive Brokers’ revenues higher.

For the first three months of 2021, the company reported diluted earnings per share of $1.16 compared to $0.60 for the same period in 2020, and adjusted diluted earnings per share of $0.98 for this quarter compared to $0.69 for the year-ago quarter.

Net revenues were $893 million and income before income taxes was $639 million for the first quarter of 2021, compared to net revenues of $532 million and income before income taxes of $308 million for the same period in 2020. Let’s note that net revenues were much stronger than in the final quarter of 2020.

General and administrative expenses for the first quarter of 2021 increased $22 million, or 59%, compared to the prior year quarter, to $59 million. This is primarily due to $19 million in additional costs for Brexit-related regulatory onboarding to bring Interactive Brokers’ new brokerage operations on line in Europe.