Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has reported its financial results for the final quarter of 2021, with net revenues slightly higher than a year ago.

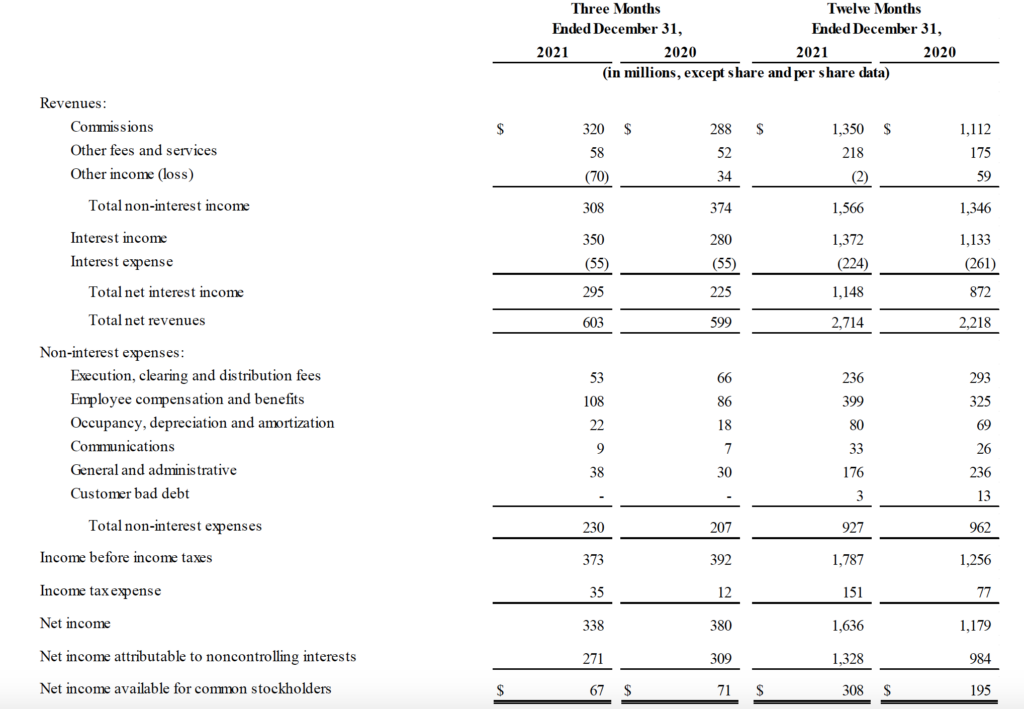

Reported net revenues were $603 million for the quarter to end-December 2021 and $683 million as adjusted. For the year-ago quarter, reported net revenues were $599 million and $582 million as adjusted. In the third quarter of 2021, net revenues amounted to $464 million.

Commission revenue increased $32 million, or 11%, from the year-ago quarter on the back of higher customer options and futures trading volumes and higher average per share commission in stocks.

Reported diluted earnings per share were $0.67 for the final quarter of 2021 and $0.83 as adjusted. For the year-ago quarter, reported diluted earnings per share were $0.81 and $0.69 as adjusted.

Reported income before income taxes was $373 million for the final quarter of 2021 and $453 million as adjusted. For the year-ago quarter, reported income before income taxes was $392 million and $375 million as adjusted.

Net interest income increased $70 million, or 31%, from the year-ago quarter thanks to higher margin loan balances and strong securities lending activity.

Other income decreased $104 million from the year-ago quarter. This decrease was mainly comprised of $89 million related to our strategic investment in Up Fintech Holding Limited (“Tiger Brokers”) and $10 million related to our currency diversification strategy.

In terms of operating metrics, let’s note that customer accounts increased 56% from the year-ago quarter to 1.68 million.

Total DARTs (daily average revenue trades) increased 16% from the year-ago quarter to 2.44 million.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on March 14, 2022 to shareholders of record as of March 1, 2022.