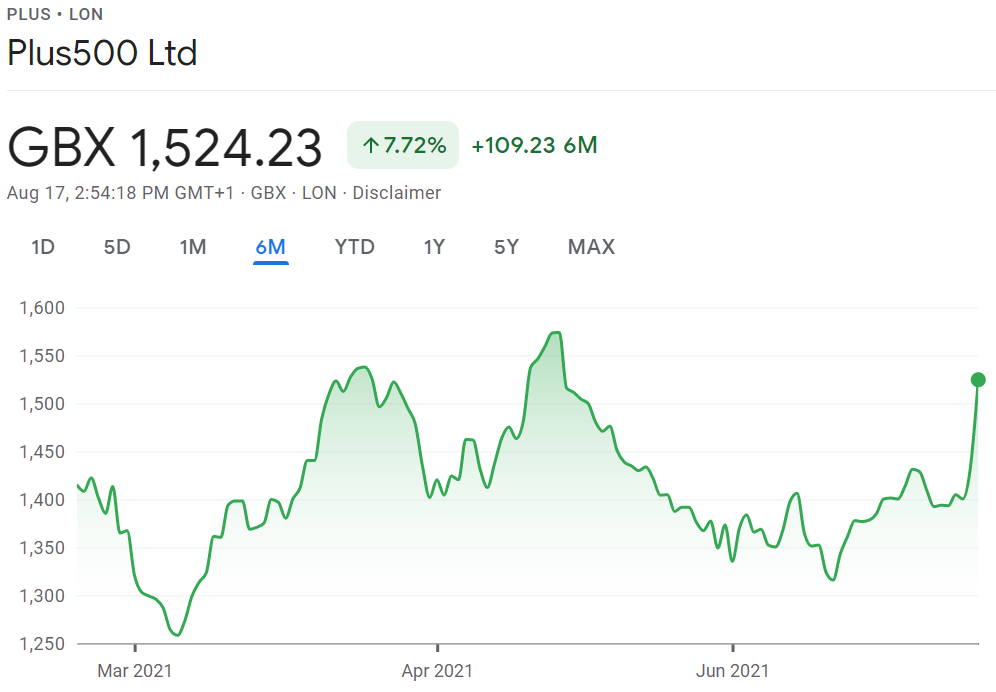

Leading online Retail FX and CFDs broker Plus500 (LON:PLUS) saw its shares rise by 8% on Tuesday, after the company released its results for the first half of 2021.

While the company had already released its top-line Revenue figures for the first half back at the beginning of July, the markets seemed to cheer the company’s continued overall level of profitability, as well as its ability to continue to grow its client base.

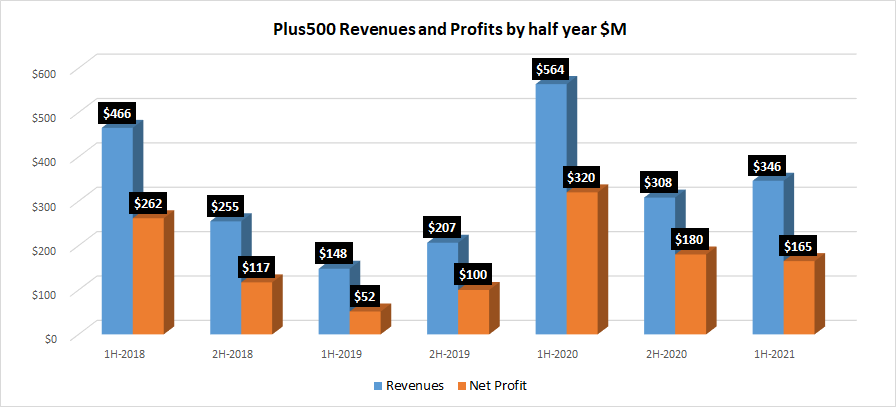

As noted, we had reported on July 12 that Plus500 revenues for Q2-2021 were down by 30% QoQ, which sent Plus500 shares on a bit of a one-week slide of 6-7% at the time. However shareholder worries that the drop in revenues might have resulted in a large profitability hit seem to have been assuaged by the full 1H report, with Plus500 earning $165 million in net income for the six month period. That was down from $180 million over the previous six months (2H-2020), but not nearly as bad as feared.

Plus500 was also able to keep the stream of new clients going in 1H-2021, signing up 136,980 customers over the six month period. And, the company’s average cost of acquiring a new client of $622 remained quite reasonable and down 2% from 1H-2020.

Part of Plus500’s success, especially in the new-client-singup realm, seems to be centered around its mobile app. The company stated that it continues to lead the industry across the mobile and tablet space, replicating the same customer experience across devices. Over 82% of Plus500’s CFD-related revenue was generated from mobile or tablet devices, with more than 78% of CFD-related customer trades taking place on mobile or tablet devices in H1 2021 (H1 2020: over 80% of revenues with more than 70% of customer trades). As a result, and reflecting Plus500’s technological capability and flexibility, the company said it is able to address directly the emerging, increasingly technology-focused, generation of traders.

David Zruia, Plus500 Chief Executive Officer, summarized the first half of 2021 as follows:

David Zruia, Plus500 Chief Executive Officer, summarized the first half of 2021 as follows:

“Plus500’s outstanding performance in H1 2021 was driven by the ability of our technology to capture the current market opportunities and to consistently provide high service levels to our customers.

“We are also delighted to have made significant progress in delivering on our vision to become a global multi-asset fintech group, with the acquisition of Cunningham and CTS, which brings access to the substantial futures and options on futures market in the US and the recent launch of the ‘Plus500 Invest’ share dealing platform in Europe. Both investments help us to diversify our range of products and further broaden our geographic footprint.

“Future growth will be delivered through continued organic investments in our business, our technology and targeted bolt-on acquisitions to further expand our CFD offering, launch new trading products, introduce new financial products and deepen engagement with our customers. Having increased our expectations for the outlook for the Group, the Board is increasingly confident that Plus500 will continue to deliver further growth and consistent levels of cash generation over the medium to long term.”

Plus500’s full first half results report can be seen here.

Plus500 share price, past six months. Source: Google Finance.