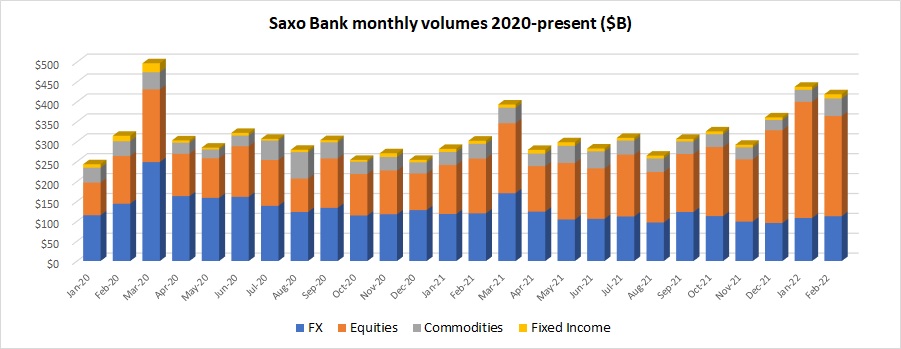

Copenhagen based Retail FX and CFDs broker Saxo Bank continued its improved start to 2022, reporting February client trading volumes that were basically flat with January.

Average daily trading volumes came in at $21.0 billion, slightly above January’s $20.9 billion ADV at Saxo Bank, although total trading volumes were down by 4% MoM – $419.1 billion versus $438.0 billion – as there were less trading days in calendar-shortened February.

Saxo Bank saw a slight slowing in Equities trading in February ($251.7 billion) after a record January ($291.7 billion). Making up the difference were increases in FX, Commodities, and Fixed Income trading.

In summary for February:

- FX trading volumes $112.7 billion, +4% MoM.

- Equities $251.7 billion, -14%.

- Commodities $43.9 billion, +45%.

- Fixed Income $10.8 billion, +38%.

Saxo Bank is controlled by Chinese conglomerate Geely Group.