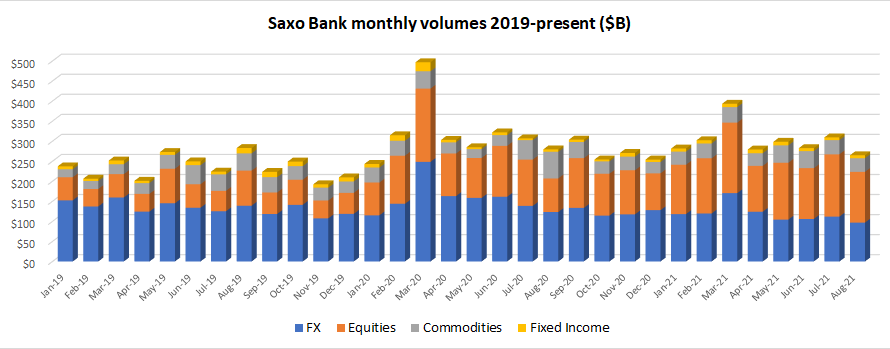

Copenhagen based Retail FX and CFDs broker Saxo Bank has released its client trading volumes for the month of August 2021, with the company reporting its slowest month for its core FX pairs product since at least 2015. (Saxo has data dating back to 2016 available).

Saxo’s $96.8 billion of FX trading volumes in August was the first time activity dropped below the $100 billion level over that span of 5+ years. The previous low for Saxo was $104.3 billion in May 2021. In 2020 Saxo averaged $146 billion in monthly FX trading volumes, which has dropped to $119 billion so far in 2021.

Overall, total Saxo Bank multi-asset trading volumes for August were $264.9 billion, down 14% from July. Equities trading was off 18.4% MoM, Commodities trading was down 3.7%, while Fixed Income trading was up 5.8%.

Saxo Bank is controlled by Chinese conglomerate Geely Group.