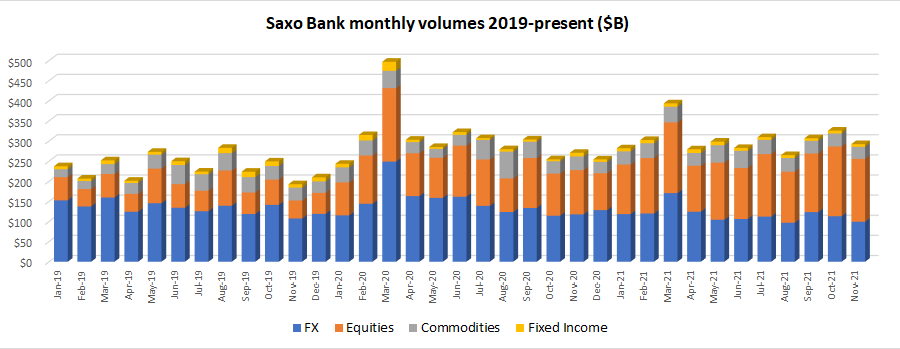

It looks like November 2021 was another rough month for Saxo Bank, as the Copenhagen based Retail FX and CFDs broker has reported month-over-month trading volume declines in all of its product categories.

In a month which saw a healthy increase in trading volumes at leading institutional FX venues, as well as record activity at some of its Retail FX broker competitors, Saxo Bank reported a volume decrease of 10.3% in November, $292.2 billion versus $325.8 billion in October.

Saxo Bank’s core FX trading volumes dropped below $100 billion for just the second time in the past number of years, coming in at $99.2 billion, down 12.2% from October’s $113 billion.

In Saxo Bank’s other product areas for November:

- Equities trading volume of $156.2 billion, -9.9% MoM

- Commodities $30.1 billion, -6.8%

- Fixed Income $6.8 billion, -2.9%

Part of the issue, in our view, is that Saxo Bank was late to the party in offering crypto trading to its retail client base. While crypto volumes have been very up-and-down at many brokers, the ability to trade crypto in the first place is what has attracted many young and new traders to the online brokers worldwide over the past 12-18 months.

Saxo Bank is controlled by Chinese conglomerate Geely Group.