TP ICAP Group plc (LON:TCAP) today provided a trading update for the three months to September 30, 2021.

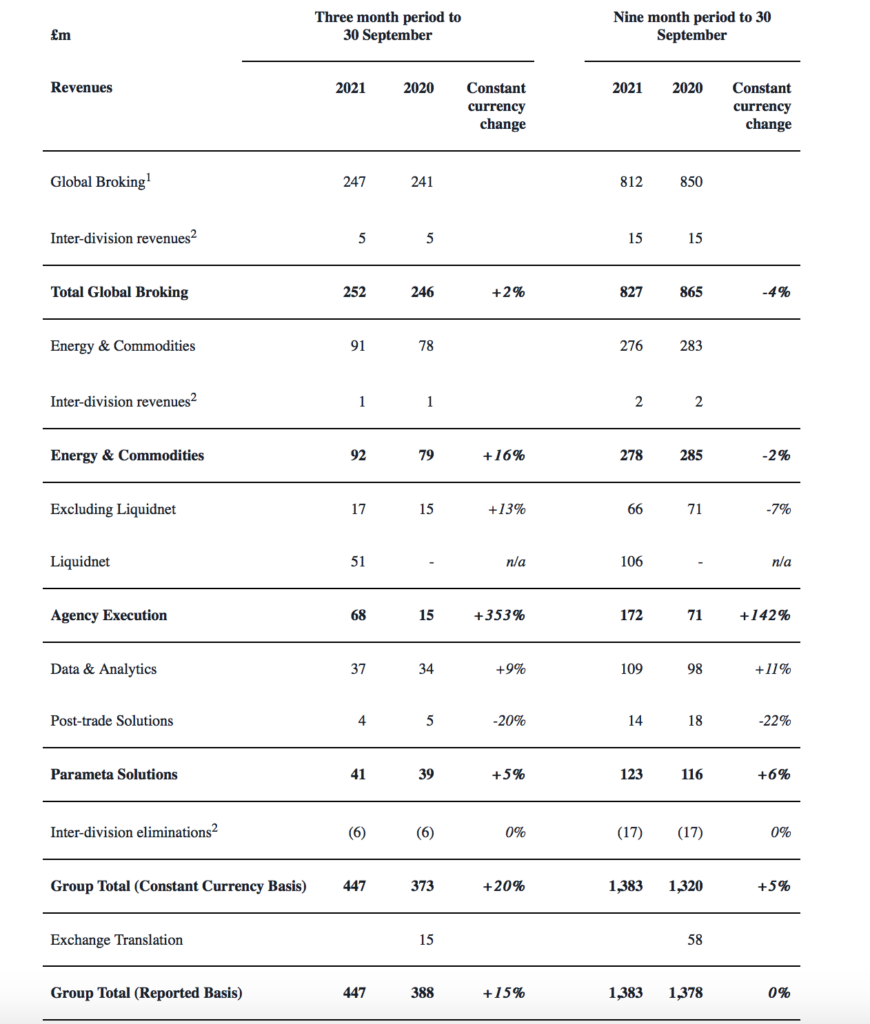

For the third quarter of 2021, Global Broking revenue amounted to £252 million, up 2%, driven primarily by a good performance in Equities, partially offset by a weaker performance in Rates.

Energy & Commodities revenue increased by 16% at £92 million, with growth across all asset classes, as energy market price volatility provided client trading opportunities.

Agency Execution revenue increased by 353% at £68 million largely due to the inclusion of Liquidnet. Excluding Liquidnet, revenue increased by 13%, driven by continued growth in the COEX brand.

TP ICAP said it continues to make good progress with its integration plans for Liquidnet and is delivering its cost synergy program ahead of expectations. The Group now expects Liquidnet post-acquisition revenue for 2021 to be at the lower end of its previously guided range of £160 million to £180 million due to lower equity market volumes globally during October.

In Parameta Solutions, Data & Analytics revenue grew by 9% as it continued to benefit from new products launched. Post-trade Solutions revenue declined by £1m.

Revenue for the nine months to 30 September 2021 of £1,383 million was 5% higher than the prior year in constant currency (2020: £1,320m), and in line on a reported basis. Excluding Liquidnet post acquisition revenue of £106m, revenue was 3% lower than the prior year in constant currency, and 7% lower on a reported basis.

Nicolas Breteau, Chief Executive Officer, TP ICAP said:

“TP ICAP capitalised on improved operating conditions during the third quarter compared with the same period last year, due to increased volatility and higher secondary trading volumes. This resulted in revenue growth across all our divisions, with particular strength in Energy & Commodities.

These favourable trends continued through October 2021 and we continue to anticipate full-year revenue for the Group, excluding Liquidnet, to be broadly in line with 2020 on a constant currency basis.”