At present, the supervision field can be divided into offshore supervision and full supervision. The offshore supervision license application conditions are relatively loose, while the full supervision regulations are more strict in the management of license issuance. Among them, Vanuatu belongs to offshore supervision.

Introduction to Vanuatu

The Republic of Vanuatu (the Republic of Vanuatu) is located in the western South Pacific, the South Pacific archipelago between Hawaii and Australia. It is a Melanesian archipelago and consists of 83 islands (68 of which are inhabited). The official languages are English, French and Bislama. The Republic of Vanuatu has a land area of 12,190 square kilometers and a water area of 848,000 square kilometers. The gift of nature to Vanuatu is rich, not only giving her fertile land, but also giving her a variety of tourism resources.

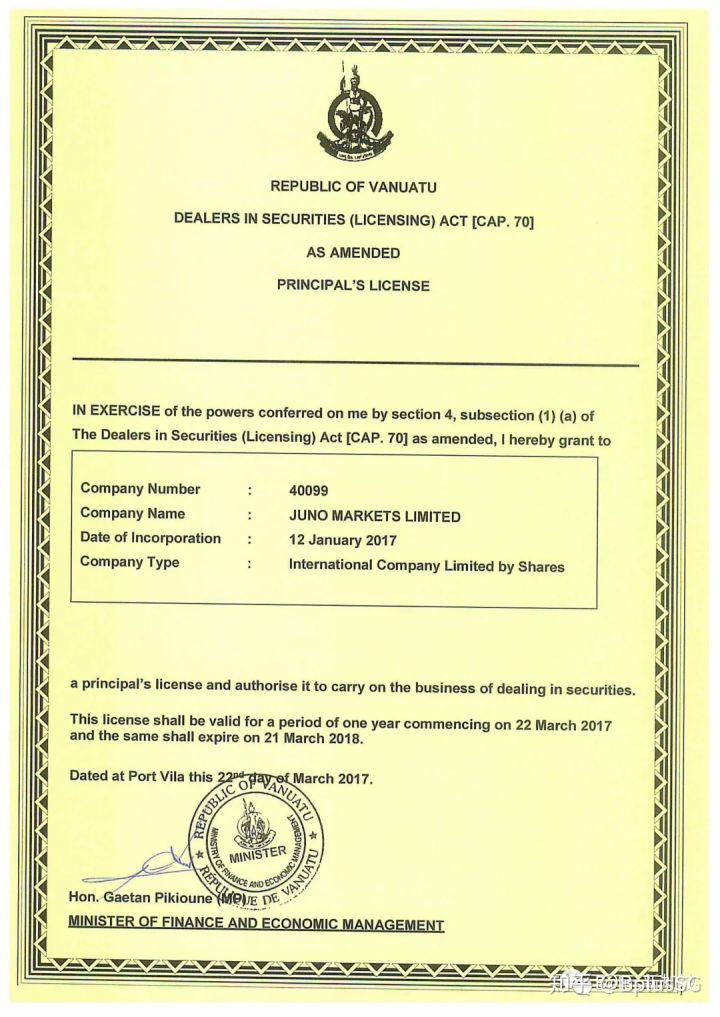

01 Introduction to Financial and Securities Dealer License (VFSC)

The Vanuatu Financial License, or Financial Institution Operating License, is the official document authorizing a financial institution to conduct business. The license is issued and regulated by the Vanuatu Financial Services Commission (VFSC for short). The VFSC financial license has become a new trend in the supervision of the global foreign exchange industry. At present, as one of the few developed offshore financial regions in the world one

02 Vanuatu investment advantages

- Vanuatu is a duty-free paradise in the South Pacific

Except for trade tax, value-added tax and business license fee, etc., there is no personal income tax, business tax, capital tax, real estate tax, inheritance tax, gift tax and withholding tax, and no global tax is levied. It has the reputation of “tax-free paradise”. Vanuatu has a mature offshore financial services center and maintains a “free port” policy with low tax rates and no foreign exchange controls. - Compared with other countries’ investment immigration laws, Vanuatu has application advantages

- The fastest time, from the approval of the passport to the naturalization of the fastest 1 month

- The threshold is extremely low and the application conditions are broad

- The information is simple and the approval process is convenient

- The investment amount is only $320,000

- No asset ownership and foreign exchange control

The local currency of Vanuatu is Vatu, which is linked to other foreign currencies and is freely convertible; the US dollar and Australian dollar are widely used; there is no foreign exchange control, and funds can be freely flown in and out; major banks in Australia, New Zealand and France have established branches in Vanuatu , such as Westpac Banking Corp, ANZ Bank and Bred Bank; it only takes two working days to send money from Hong Kong to Vanuatu. - Holding a Vanuatu passport can get great investment convenience

Due to the government’s protection of domestic investors, foreign investors are not allowed to enter in many investment activities. Vanuatu lists tourism and agriculture as key priority investment industries. The Government of Vanuatu stipulates that certain investment activities such as travel agencies, inter-island trade, private housing construction, offshore fishing operations, etc., are limited to domestic investors.

Vanuatu has abundant resources, but the productivity level is relatively low and the industrial space is huge, and this is the best investment opportunity.

Vanuatu has obvious advantages in resources and ecology. In recent years, it has increased investment in infrastructure, including roads, water, electricity, communications, etc., and conditions have improved. At this time, investment dividends will be released faster.

03 Benefits of Vanuatu Financial License

- Many top brokers around the world recognize the VFSC financial license

- Open an international bank account for cross-border transactions

- Have the law to protect customers more trust

- Timely collection and payment without arrears

- The region where the license belongs to strictly supervise transaction security

- Regulated brokers are trustworthy and reliable

04 Documents required to apply for a license

- Notarized passport of shareholders

- Notarized copy of the shareholder’s utility bill within two months

- Notarized certificate of no criminal record of shareholders

- The company’s business plan within 3-5 years

- Other relevant information

05 Transaction Types Supported by License

The Vanuatu financial license supports a variety of transaction services, such as: remittance business, payment industry, foreign exchange transactions, commodities, securities transactions, financial consulting, etc. In particular, it is very suitable for Chinese securities companies, because Vanuatu’s political and economic interests in China are actively protected and supported by the Chinese government.

06 Application fee and payment method

·USD 48,000, to be paid before processing. Welcome to pay by cash, transfer, wire transfer, cheque or cashier’s order to the designated Hong Kong or Mainland China bank account of Dennett.

·Submit an application for a Vanuatu financial and securities dealer trading license. The company registration information and documents are highly confidential, and funds and assets can be effectively protected. The cost of opening a company and applying for a license is low, tax policies can be used reasonably, and the company is easy to manage.

·In addition, after setting up a company in Vanuatu, it will facilitate investment and financing in the future, taking the first step for the company to go public overseas. Conducive to the development of transnational business, enhance corporate image and enhance political status.