About OctaFX

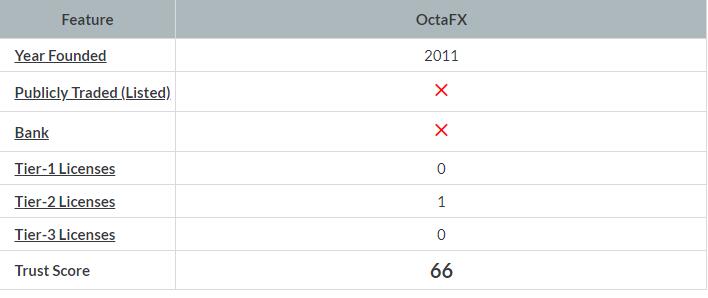

Founded in 2011, OctaFX is part of a group of global entities, which include Octa Markets Incorporated (based in Saint Vincent and the Grenadines) and Octa Markets Cyprus Ltd (based in Cyprus).

Is OctaFX Safe?

OctaFX is considered high-risk, with an overall Trust Score of 66 out of 99. OctaFX is not publicly traded and does not operate a bank. OctaFX is authorised by zero tier-1 regulators (high trust), one tier-2 regulator (average trust), and zero tier-3 regulators (low trust).

Regulations Comparison

Is OctaFX a good broker?

OctaFX is an up-and-coming broker that has been in operation for nearly 10 years. Its growth has enabled OctaFX to continue to expand its products and services. Adding additional regulatory licenses in tier-1 jurisdictions would be a step toward winning more client trust.

Is my money safe with OctaFX?

As OctaFX is only regulated in Cyprus, we consider the broker to be a higher risk than those firms that are regulated in numerous tier-1 jurisdictions.

Founded in 2011, OctaFX holds regulatory licenses primarily in Europe through its Cyprus-based entity – Octa Markets Cyprus Ltd – which is regulated by the Cyprus Securities and Exchange Commission (CySEC). Your account may be eligible for certain CySEC protections – in the extraordinary event of Octa Markets Cyprus Ltd.’s bankruptcy, for example, you’ll be protected for up to 20,000 euros from the Investor Compensation Fund (ICF).

The brand’s international entity, Octa Markets Incorporated, is the brand’s international entity. It is based in St. Vincent and the Grenadines (SVG), and it provides little to no regulatory protection. The security of your funds – in terms of regulatory protection – will depend on which OctaFX entity holds your account, and which –if any – relevant regulations provide customer protections.

Final thoughts

OctaFX offers the full MetaTrader suite, albeit with a fairly limited offering of tradeable instruments. There’s no question – if OctaFX wants to compete with the best MetaTrader brokers, it needs to make improvements in its range of products and its research and education.

Though it has been granted regulatory status in Cyprus, OctaFX’s lack of additional reputable licenses heavily weighs down its Trust Score. Becoming regulated in more jurisdictions – especially tier-1 jurisdictions – will go a long way towards building trust with existing and prospective customers.