What is XTrade?

The broker XTrade firstly known as XFR Financial Ltd was established back in 2003, while recently headquarters in Cyprus and offering traditional trading through CFDs on shares, commodities, forex and indices.

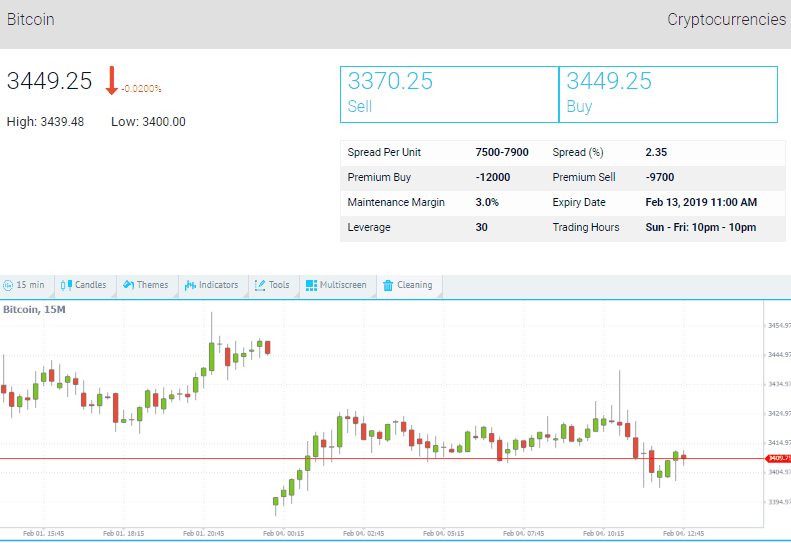

The company also continuously increases their ranges and add instant access to the most popular Cryptocurrencies that are available 24/7 directly through the trading platform: Bitcoin, Bitcoin Cash, Litecoin, Dash, Ethereum, Ripple and other digital coins.

The international proposal through performed through stablished entity in Belize that allows international traders to open account and also get high leverage or other conditions. Yet, be sure you learn differences about regulations and conditions well.

XTrade Pros and Cons

XTrade is a trusted broker with CySEC regulation. XTrade provides good trading technology with platform selection and spreads on average-low basis, the account opening is fast and there is selection of Forex and CFD instruments.

On the negative side the are some limitations in product offering, support is no available 24/7 also international proposal is done via Belize entity.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC, FSC |

| 🖥 Platforms | MT4, XTrade WebTrader |

| 📉 Instruments | CFDs on shares, commodities, forex and indices, Cryptocurrencies |

| 💰 Costs | 0.6 pips |

| 🎮 Demo Account | Offered |

| 💳 Minimum deposit | 250$ |

| 💰 Base currencies | Three currencies available |

| 📚 Education | Free education with courses and daily analysis |

| ☎ Customer Support | 24/5 |

Awards

In fact, XTrade through the long operation spread around globally while serving clients from a vast number of countries. As a recognized company in online trading with years of experience and worldwide presence, the firm confirmed its status by many awards and industry achievements.

Xtrade & Cristiano Ronaldo – The broker supports various social activities which increase their presence in world picture. Cristiano Ronaldo was Xtrade official ambassador of 2016-2017, which signifies an opportunity to support the world’s greatest footballer while promoting marketing-leading CFD trading products.

Is XTrade safe or a scam

No, XTrade considered safe broker because is authorized by CySEC to provide lower risk Forex and CFD trading.

Is XTrade legit?

The XTrade group and the company fully comply with the CySEC regulation, as per their headquarters in Cyprus and its obtained license, along with numerous registration and authorization across the EEA zone. The international brand that serves worldwide clients XTrade International operates in various jurisdictions through its license obtained by the Financial Service Commission in Belize (IFSC).

Even in fact this license if offshore one, which regarded as not safe enough on its own, yet the additional regulation by the European entities confirms that the broker strictly complies with the international protective measures.

How are you protected?

The client’s funds are always segregated as we see through our XTrade Review, means an account in which the trader’s assets are kept is separated from the broker’s assets that enable security and money protection, while also every client account is opened under the Investor Compensation Fund.

Furthermore, Xtrade continuously monitors its operations as per regulatory requirement and provide comprehensive security for all online transaction or manipulations provided.

In addition, according to the regulation sets the trader cannot lose more than the initial deposit, since the broker applied negative balance protection, which all in all makes XTrade considered to be a safe Forex broker.

Leverage

Leverage is a quite unique opportunity to magnify trading potential using the tool of leverage. However, every trader should remember that leverage can work both for you as well as against you, so you should be cautious when using it and learn more how to use tool smartly.

In terms of XTrade leverage offering, as there are two main regulatory obligations the clients of different jurisdictions will fall under specific levels of leverage.

- European clients or those traders that are operated under the CySEC regulation, as per current updates are allowed to use maximum leverage of 1:30.

- The International clients operated through XTrade International may enjoy leverage till 1:400.

Account types

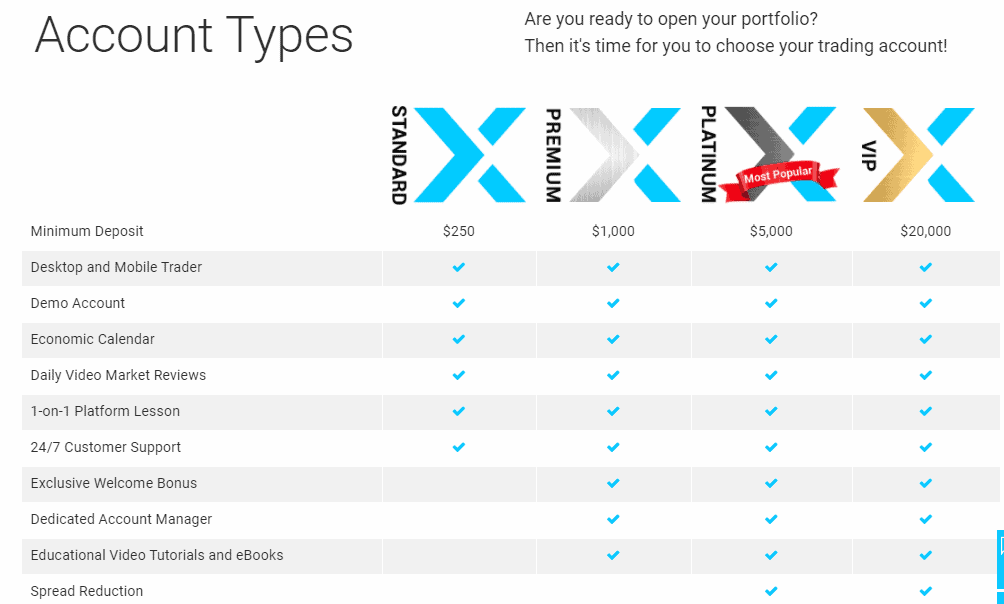

Through one Xtrade single account you are able to trade across multiple devices that make no difference between the traders. At the beginning, the trader can always try out the risk-free environment through Demo-account opening.

You can either grow your account so once the account reach or holds a balance of a certain amount it will turn either to Premium Account with 1,000$ balance, Platinum Account with 5,000$ and VIP Account 25,000$ accordingly. The trading conditions won’t be different and features the same support, education, news and available numerous signals. Yet, there is a spread reduction and additional education videos available for Platinum and VIP account holders.

Trading Instruments

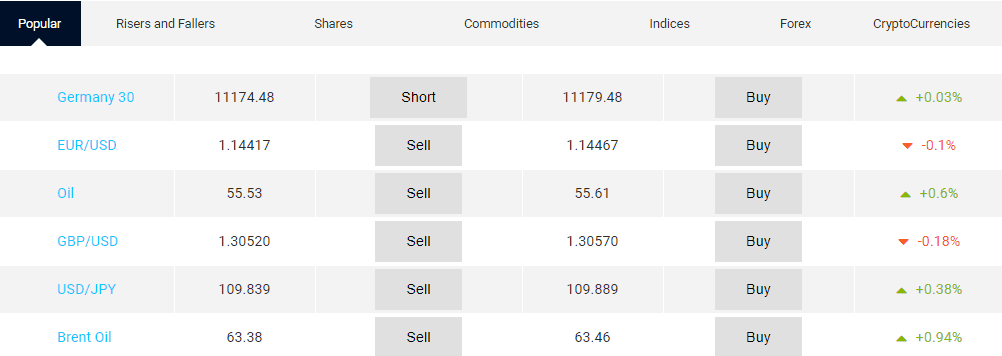

The XTrade trading instruments or trading products are offered through a popular CFDs or Contract for Difference model, which allows vast flexible opportunities on price speculation without particular ownership of an asset.

– Xtrade Equity CFDs allow trading CFDs worldwide on the most actively traded shares– Apple, Google, Nike, JP Morgan, IBM, etc. With a 5% Initial Margin.

– Forex Trading includes the most popular international currency pairs – EUR/USD, USD/JPY, etc, as well as the highly demanded Cryptocurrencies. Xtrade trading system provided over 50 leveraged Forex pairs with leverage up to 1:400.

– Index CFDs – S&P 500, Dow Jones, etc. The contract value of one Index CFD equals the price quoted in the currency of the Index. The broker offers the market fixed spreads between the buy and sell prices and no commissions.

– Commodity CFDs – Gold, Silver, Oil, Natural Gas, etc. The contract value of one Commodity CFD equals the price quoted in the currency of the commodity. For example, if Gold CFDs are trading at $1,200.50, then the value of one ounce Gold CFD is $1,200.50.

Fees

The XTrade offers various technical solutions and tools for better trading conditions, along with reduced costs with no commission policy but only fixed spreads (e.g. spreads between the buy and sell prices for EUR/USD 2-5 pips). Additional costs like non-trading fees, funding fees and inactivity fees are ranked below.

| Fees | XTradeFees | BDSwiss Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | High | Average |

Spreads

XTrade trading fees are based on a XTrade Spreads Only strategy, with a fixed amount, means that traders’ costs included into a spread, which is the difference between the bid and the ask price of a financial instrument. To see the Spread value for each product please refer to the table below that gives you a reference on a price model, however, check the most accurate data on the official Xtrade website or platform.

However, the trader will have a better price offering from the XTrade broker as long as account size or type increases. Thus, the spread of the common EUR/USD pair is fixed to 5 pips in Standard Account, 3 pips in Premium and Platinum, 2 pips in VIP account.

Overall XTrade spreads considered to be a low spread offering among the market, for instance, check out and compare Xtrade to FP Markets fees.

| Asset/ Pair | XTrade Spread | BDSwiss Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pips | 1.5 pips | 1.3 pips |

| Crude Oil WTI Spread | 1.5 | 6 | 3 |

| Gold Spread | 10 | 25 | 40 |

| BTC USD Spread | 95 | 2000 | 0.75% |

Swap fee

Keeping a position open after a specific hour (approximately 22:00GMT), subject trader to an Xtrade funding premium fee or overnight fee that is subtracted from the trading account. This premium covers the cost of the associated funding and varies from the asset for another, e.g. Eur/Usd fee for sell or buy is around 1.8.

Deposits and Withdrawals

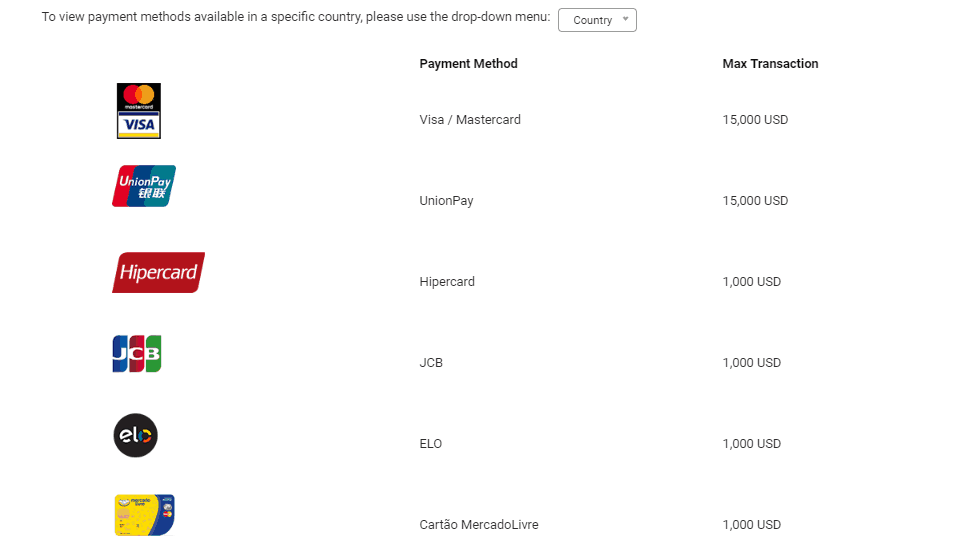

To deposit or withdraw the funds, the client has many options to choose from, yet, depending on the client’s location, which you can easily check through the official XTrade website.

Deposit options

The available methods include the following ones, so you can choose the most convenient one for you.

- Credit/debit cards,

- bank transfers,

- American Express,

- PayPal,

- Skrill and many more common options.

There are no deposit or withdrawal fees charged to the client from the company,

XTrade minimum deposit

The XTrade minimum deposit is 200$, yet you should calculate and cover necessary expenses since the variety of trading instruments offers different margins and spreads. E.g. to open a new position at equity, account must exceed the trade’s initial margin level requirement. Also, Xtrade occasionally runs promotions offering lower deposit threshold minimums.

XTrade minimum deposit vs other brokers

| XTrade | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawal

XTrade Withdrawal fee or deposit charge is 0$, means the broker covers transaction expenses, unless your own bank or payment method requires some performance charges in case of the wire transfers. If you deposit via credit card, any withdrawal amounts will be returned to that credit card. Likewise, if a deposit is made via bank transfer, the withdrawals will be transferred back to your bank account.

Trading Platforms

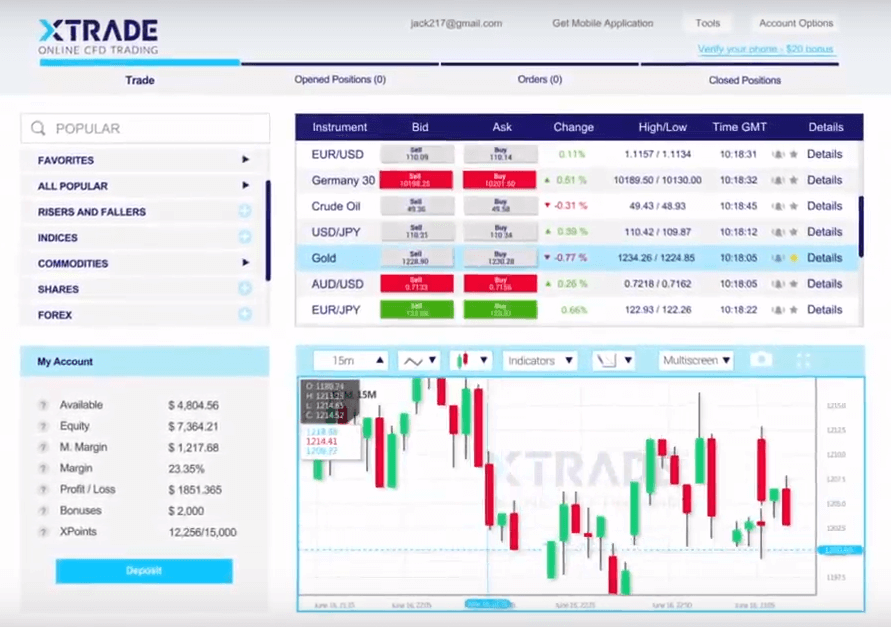

The Xtrader platform range offers mainly an online-based proprietary software, as well as to stay trading with an industry leader MetaTrader4. However, the proprietary platform gained numerous rewards, from both industry professionals and the traders, thus you may try and then never leave XTrade platform.

| Pros | Cons |

|---|---|

| Proprietary Web trading platform | None |

| User friendly design and login | |

| Price alerts | |

| MT4 offered as well | |

| Supporting many languages |

Web Platform

The platform does not require installation and offers a rich set of trading tools for optimal trading, as well enriched with market analysis and fast execution of orders.

Mobile Trading

In order to never miss an opportunity, Xtrade developed a powerful mobile platform that is available on iOS, Android and Windows. The mobile platform is a customer-friendly and supported by alerts and professional charting tools.

Desktop platform

Overall, as a trader you will get access to real-time charting and almost all possible manipulations in the web platform or its applications, which is fully intuitive and easy to understand or perform even to the newbies, not considering professionals that will find the full capacity of very powerful features.

Customer Support

XTrade provides also multiple support that increases the trading experience and makes it a smooth process. You can reach out customer team through live chat, email or phone lines, also due to international coverage, there is multilingual support and centers that run 24/5.

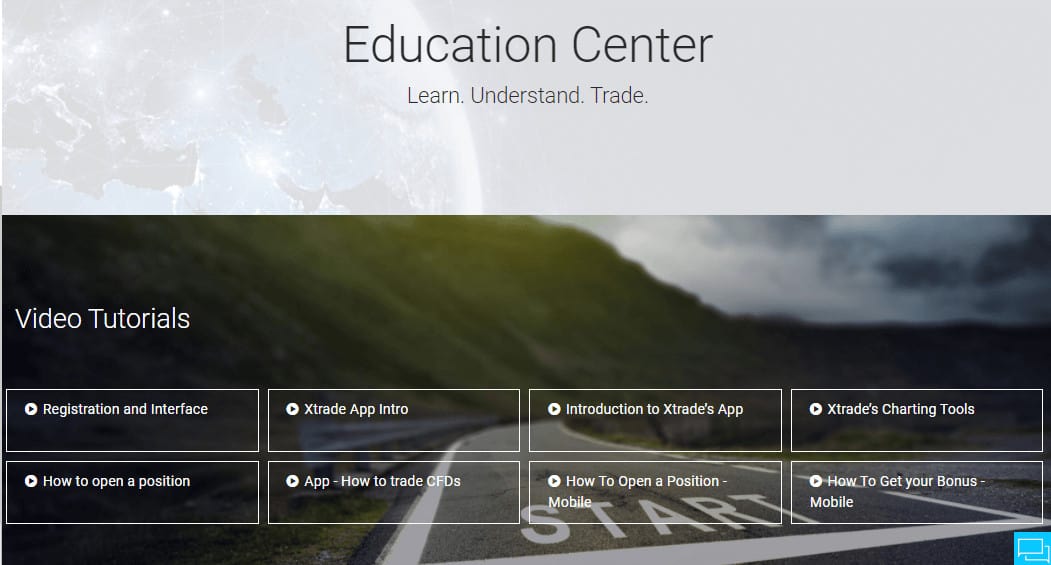

Education

You are able to develop trading skills and strategies with professional trading tools, along with educational resources and daily market reviews, which makes it possible for beginners to join as well.

In addition, there is an economic calendar, analysis tools and News feed inbuilt into the platform, daily analysis video and other education support essential for everyday trading.

Conclusion

Concluding XTrade review, the broker brings stable and reliable conditions to trade. Their main offering mainstays on a fixed spread with no hidden fees, powerful online-based platform and comprehensive trading instruments variety. As a regulated broker, the company does follow the strict rules of the client’s protection along with the funds’ security and safe trading environment. What is pleasing also, is that XTrade supports their traders by various means, from excellent support to 0$ fees on money transactions, as well as widely supported methods.